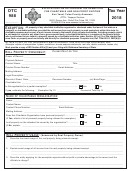

Page 3 of 6

10. CFO authorizing/approving official information

Seller (

organization name)

Internal Revenue Service

a. Official's name

b. Official's title

c. Telephone number

d. Email address

e. Signature/Date

11. Authorizing/Approving official information

Internal Revenue Service

Buyer (

Seller (

organization name)

organization name)

a. Official's name

a. Official's name

b. Official's title

b. Official's title

c. Telephone number

c. Telephone number

d. Email address

d. Email address

e. Signature/Date

e. Signature/Date

11a. Co-Signature for authorizing/approving official

(as appropriate)

Buyer (

Seller

organization name - optional)

(business unit name - optional)

a. Official's name

a. Official's name

b. Official's title

b. Official's title

c. Telephone number

c. Telephone number

d. Email address

d. Email address

e. Signature/Date

e. Signature/Date

For example, a Buyer may require more than one approving official to ratify

For example, co-signatures from approving officials in more than one

a reimbursable agreement.

business unit may be required under statutory authorities governing

reimbursable agreements with foreign entities.

Legal Terms and Conditions

1. IRS Reimbursable Authority: The authority to perform services on a cost reimbursable basis is contained in sections 6103(p)(2)

and 6108(b) of the Internal Revenue Code (IRC). Performance of services is authorized only when consistent with the basic public

obligations of the Internal Revenue Service (IRS). If necessary to fulfill its public obligations, the IRS may modify, reject, cancel, or

terminate any part of this agreement and return the unused balance of funds advanced.

1a. Section 6103(p)(4) of the IRC provides specific requirements for Federal, state, and local organizations to safeguard Federal tax

returns and return information as a condition of receiving the information. IRS Publication 1075, Tax Information Security Guidelines for

Federal, State, and Local Agencies (OMB No. 1545-0962) provides additional guidelines.

1b. Section 7213 of the IRC makes unauthorized disclosure of a return or return information a felony punishable by a fine not to exceed

$5,000 or imprisonment of not more than 5 years, or both, together with the costs of prosecution. Section 7213A makes unauthorized

inspection of a return or return information punishable by a fine up to $1,000, or imprisonment of not more than one year, or both,

together with the costs of prosecution. Section 7431 makes persons who knowingly or negligently make an unauthorized disclosure of a

return or return information liable for civil damages.

14417

Form

(Rev. 2-2013)

Catalog Number 59893X

1

1 2

2 3

3 4

4 5

5 6

6