Page 6 of 6

Field

Field Name

Field Action

Number

Enter the valid Taxpayer Identification Number (TIN) or Employee Identification Number (EIN) of the

9.g.

TIN/EIN

Buyer.

9.h.

DUNS

Enter the Dun and Bradstreet Universal Numbering System (DUNS) of the Buyer.

Seller - Government Payables and

Receivable Section

9.a.

IRS Office name

Pre-populated with BFC GPRS Helpdesk.

9.b.

Telephone number

Pre-populated with BFC GPRS Helpdesk telephone number.

9.c.

Fax number

Pre-populated with BFC GPRS Helpdesk fax number.

9.d.

Email address

Pre-populated with BFC GPRS Helpdesk email address.

9.e.

TIN/EIN

Pre-populated with IRS Taxpayer Identification Number (TIN).

Enter payment method option: 1) Paper Check, 2) Electronic Check via Pay.gov, 3) Money Order, or

Payment method

4) Other. If another method is selected, describe the method used. One box must be checked.

CFO authorizing/approving official

10.

information

Seller

10.a.

Official's name

Enter the name of the Director, Budget Execution.

10.b.

Official's title

Enter Director, Budget Execution.

10.c.

Telephone number

Enter the telephone number of the Director, Budget Execution.

10.d.

Email address

Enter the email address of the Director, Budget Execution.

The Director, Budget Execution must sign and date to authorize the funding of products and/or services

provided to the buyer on behalf of the seller. Work on the project Work on the project will not begin until

10.e.

Signature/Date

the sign-off has occurred.

Note: Section 11a includes additional Buyer and Seller Authorizing/Approving information fields for cases

11.

Authorizing/Approving official information

where a program area requires multiple authorizing/approving officials.

Buyer

11.a.

Official's name

Enter the name of the Buyer's Authorizing/Approving official.

11.b.

Official's title

Enter the title of the Buyer's Authorizing/Approving official.

11.c.

Telephone number

Enter the telephone number of the Buyer's Authorizing/Approving official.

11.d.

Email address

Enter the email address of the Buyer's Authorizing/Approving official.

The Buyer's Authorizing/Approving Official must sign and date to authorize the purchase of products and/

or services provided on behalf of the requesting entity. Work on the project cannot begin until final

11.e.

Signature/Date

signatures have been obtained.

Seller

11.a.

Official's name

Enter the name of the IRS Authorizing/Approving official. Must be an IRS Employee.

11.b.

Official's title

Enter the title of the IRS Authorizing/Approving official.

11.c.

Telephone number

Enter the telephone number of the IRS Authorizing/Approving official.

11.d.

Email address

Enter the email address of the IRS Authorizing/Approving official.

The IRS Authorizing/Approving Official must sign and date to authorize the funding of products and/or

services provided to the buyer on behalf of the seller. Work on the project will not begin until the sign-off

11.e.

Signature/Date

has occurred.

Co-Signature for authorizing/approving

Includes additional Buyer and Seller Authorizing/Approving information fields for cases where a program

11a.

official (as appropriate)

area requires multiple authorizing/approving officials.

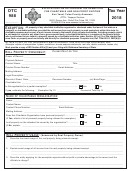

Paperwork Reduction Act Notice. We ask for the information on this form to carry out the Internal Revenue laws of the United States. You are required

to give us the information. We need it to ensure that you are complying with these laws.

You are not required to provide the information requested on a form that is subject to the Paperwork Reduction Act unless the form displays a valid OMB

control number. Books or records relating to a form or its instructions must be retained as long as their contents may become material in the

administration of any Internal Revenue law. Generally, tax returns and return information are confidential, as required by section 6103.

The time needed to complete and file this form will vary depending on individual circumstances. The estimated burden for filing this form is approved

under OMB control number 1545-2235. The estimated burden is shown below.

Recordkeeping . . . . . . . . . . 0.

Learning about the law or the form . . . . . . . . . . . . 10 min.

Preparing and sending the form to the IRS . . . . . . . . . 20 min.

If you have comments concerning the accuracy of these time estimates or suggestions for making this form simpler, we would be happy to hear from

you. See the instructions above.

14417

Form

(Rev. 2-2013)

Catalog Number 59893X

1

1 2

2 3

3 4

4 5

5 6

6