Page 5 of 6

Field

Field Name

Field Action

Number

2.c.

IRS Business Unit name

Enter IRS Business Unit Name.

Enter the address - street number, street name, city, state, and zip code of the IRS Budget Office

2.d.

Address

Reimbursables Coordinator official.

Enter the telephone number of the IRS Budget Office Reimbursables Coordinator official related to the

2.e.

Telephone number

reimbursable agreement.

Enter the fax number of the IRS Budget Office Reimbursables Coordinator official related to the

2.f.

Fax number

reimbursable agreement.

Enter the email address of the IRS Budget Office Reimbursables Coordinator official related to the

2.g.

Email address

reimbursable agreement.

Internal Revenue Code section references box is pre-populated. These statutory references always

apply. Other Statutory Authority - This box should be checked when an additional statutory authority

3.

Statutory authority

applies. Enter additional statutory authority on the line provided, if applicable.

Enter agreement-related action type. (e.g., New, Amendment, or Cancellation)

1) Either New or Amendment must be checked.

4.

Agreement action

2) If Amendment is checked, then either Increase, Decrease or Cancellation must be checked.

Enter the following information:

1) The start date of the agreement (effective date)

2) The end date of the agreement (the estimated completion date for support under this

agreement). Note: IRS agreements operate on a fiscal year basis. Funding received from state,

local and foreign governments applies to the current fiscal year only. Multi-year funding cannot be

retained or applied to future fiscal years.

5.

Agreement period of performance

3) Enter the cancellation date of the agreement, if applicable.

Description of requested products and/or

Enter a description of requested products and/or services to be provided by the IRS, including scope of

6.

services to be provided

work or work statement to support delivery orders.

Non-federal customers must provide an advance payment before the IRS begins any work for the

full cost of goods and/or services to be provided.

Indicate the type of draw down method to be used: One box must be checked which denotes the

frequency of revenue recognition and frequency of the advance draw down. "Monthly" is the

7.

Advance payment requirements

recommended drawn down frequency.

Breakdown of reimbursable cost

estimate

Unit of measure applicable to project

Indicate the unit of measure that will be used to cost the project.

Item quantity (A)

Enter the number of items, hours, or other unit of measure related to the project, as applicable.

Unit price (B)

Enter the unit price of the product being delivered or services being rendered, as applicable.

Total direct costs (A X B)

Enter total direct costs. See IRM 1.33.8 Reimbursable Operating Guidelines - Costing.

Enter the total indirect/overhead costs. Examples of indirect/overhead Costs include: a) General

management and administrative services, b) Facilities management and ground maintenance services

(security, rent, utilities, and building maintenance), c) Procurement and contracting services, d) Financial

management and accounting services, e) Information technology services, f) Services to acquire and

operate property, plant and equipment, g) Publication, reproduction, graphics and video services,

h) Research, analytical, and statistical services, i) Human resources/personnel services, and j) Library

Indirect/Overhead costs

and legal services. See IRM 1.33.8 Reimbursable Operating Guidelines - Costing.

Total estimated costs

Enter the total amount of estimated costs which equals direct and indirect/overhead costs.

Initial reimbursable agreement amount,

Enter the initial reimbursable agreement amount or the initial reimbursable agreement amount amount

including any prior amendments

adjusted for any increases or decreases before the most recent amendment.

Current amendment - increase

(decrease)

Enter the current amendment amount - increase (decrease), as applicable.

Total current reimbursable agreement

Enter the summation of the Initial Reimbursable Agreement Amount, including any prior amendments

8.

amount

and Current Amendment - increase (decrease) fields.

Billing & collection contact information

9.

and payment requirements

Finance Office Representative

9.a.

Official's name

Enter the name of the Buyer's Finance Office Representative official.

9.b.

Official's title

Enter the title of the Buyer's Finance Office Representative official.

Enter the address - street number, street name, city, state, and zip code of the Buyer's Finance Office

9.c.

Billing address

Representative official.

Enter the telephone number of the Buyer's Finance Office Representative official for correspondence on

9.d.

Telephone number

billing and collection issues.

Enter the fax number of the Buyer's Finance Office Representative official for correspondence on billing

9.e.

Fax number

and collection issues.

Enter the email address of the Buyer's Finance Office Representative official for correspondence on

9.f.

Email address

billing and collection issues.

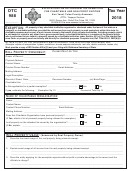

14417

Form

(Rev. 2-2013)

Catalog Number 59893X

1

1 2

2 3

3 4

4 5

5 6

6