2

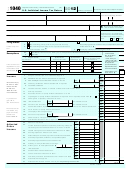

Form 1120 (2012)

Page

Schedule C

Dividends and Special Deductions (see instructions)

(a) Dividends

(c) Special deductions

(b) %

received

(a) × (b)

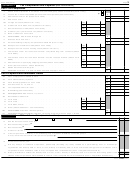

1

Dividends from less-than-20%-owned domestic corporations (other than debt-financed

stock)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

70

2

Dividends from 20%-or-more-owned domestic corporations (other than debt-financed

stock)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

80

see

instructi

3

Dividends on debt-financed stock of domestic and foreign corporations .

.

.

.

.

ons

4

Dividends on certain preferred stock of less-than-20%-owned public utilities

.

.

.

42

5

Dividends on certain preferred stock of 20%-or-more-owned public utilities .

.

.

.

48

6

Dividends from less-than-20%-owned foreign corporations and certain FSCs .

.

.

70

7

Dividends from 20%-or-more-owned foreign corporations and certain FSCs

.

.

.

80

8

Dividends from wholly owned foreign subsidiaries

.

.

.

.

.

.

.

.

.

.

.

100

9

Total. Add lines 1 through 8. See instructions for limitation

.

.

.

.

.

.

.

.

10

Dividends from domestic corporations received by a small business investment

company operating under the Small Business Investment Act of 1958

.

.

.

.

.

100

11

Dividends from affiliated group members .

.

.

.

.

.

.

.

.

.

.

.

.

.

100

12

Dividends from certain FSCs

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

100

13

Dividends from foreign corporations not included on lines 3, 6, 7, 8, 11, or 12

.

.

.

14

Income from controlled foreign corporations under subpart F (attach Form(s) 5471)

.

15

Foreign dividend gross-up

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

IC-DISC and former DISC dividends not included on lines 1, 2, or 3 .

.

.

.

.

.

17

Other dividends

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

Deduction for dividends paid on certain preferred stock of public utilities

.

.

.

.

19

Total dividends. Add lines 1 through 17. Enter here and on page 1, line 4 .

.

.

▶

20

Total special deductions. Add lines 9, 10, 11, 12, and 18. Enter here and on page 1, line 29b .

.

.

.

.

.

.

▶

1120

Form

(2012)

1

1 2

2 3

3 4

4 5

5