4

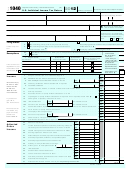

Form 1120 (2012)

Page

Schedule K

Other Information continued (see instructions)

Yes

No

5

At the end of the tax year, did the corporation:

a

Own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of stock entitled to vote of

any foreign or domestic corporation not included on Form 851, Affiliations Schedule? For rules of constructive ownership, see instructions.

If “Yes,” complete (i) through (iv) below.

(ii) Employer

(iv) Percentage

(iii) Country of

(i) Name of Corporation

Identification Number

Owned in Voting

Incorporation

(if any)

Stock

b Own directly an interest of 20% or more, or own, directly or indirectly, an interest of 50% or more in any foreign or domestic partnership

(including an entity treated as a partnership) or in the beneficial interest of a trust? For rules of constructive ownership, see instructions.

If “Yes,” complete (i) through (iv) below.

(ii) Employer

(iv) Maximum

(iii) Country of

(i) Name of Entity

Identification Number

Percentage Owned in

Organization

(if any)

Profit, Loss, or Capital

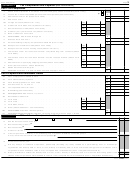

During this tax year, did the corporation pay dividends (other than stock dividends and distributions in exchange for stock) in

6

excess of the corporation’s current and accumulated earnings and profits? (See sections 301 and 316.)

.

.

.

.

.

.

.

If "Yes," file Form 5452, Corporate Report of Nondividend Distributions.

If this is a consolidated return, answer here for the parent corporation and on Form 851 for each subsidiary.

7

At any time during the tax year, did one foreign person own, directly or indirectly, at least 25% of (a) the total voting power of all

classes of the corporation’s stock entitled to vote or (b) the total value of all classes of the corporation’s stock?

.

.

.

.

For rules of attribution, see section 318. If “Yes,” enter:

(i) Percentage owned

and (ii) Owner’s country

▶

▶

(c) The corporation may have to file Form 5472, Information Return of a 25% Foreign-Owned U.S. Corporation or a Foreign

Corporation Engaged in a U.S. Trade or Business. Enter the number of Forms 5472 attached

▶

8

Check this box if the corporation issued publicly offered debt instruments with original issue discount .

.

.

.

.

.

▶

If checked, the corporation may have to file Form 8281, Information Return for Publicly Offered Original Issue Discount Instruments.

Enter the amount of tax-exempt interest received or accrued during the tax year

$

9

▶

10

Enter the number of shareholders at the end of the tax year (if 100 or fewer)

▶

11

If the corporation has an NOL for the tax year and is electing to forego the carryback period, check here

.

.

.

.

.

▶

If the corporation is filing a consolidated return, the statement required by Regulations section 1.1502-21(b)(3) must be attached

or the election will not be valid.

Enter the available NOL carryover from prior tax years (do not reduce it by any deduction on line 29a.)

$

12

▶

13

Are the corporation’s total receipts (line 1c plus lines 4 through 10 on page 1) for the tax year and its total assets at the end of

the tax year less than $250,000?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If “Yes,” the corporation is not required to complete Schedules L, M-1, and M-2 on page 5. Instead, enter the total amount of cash

$

distributions and the book value of property distributions (other than cash) made during the tax year

▶

Is the corporation required to file Schedule UTP (Form 1120), Uncertain Tax Position Statement (see instructions)?

.

.

.

.

14

complete and attach Schedule UTP.

If “Yes,”

15a

Did the corporation make any payments in 2012 that would require it to file Form(s) 1099?

.

.

.

.

.

.

.

.

.

.

.

b

If “Yes,” did or will the corporation file required Forms 1099? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

During this tax year, did the corporation have an 80% or more change in ownership, including a change due to redemption of its

own stock?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

During or subsequent to this tax year, but before the filing of this return, did the corporation dispose of more than 65% (by value)

of its assets in a taxable, non-taxable, or tax deferred transaction?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

18

Did the corporation receive assets in a section 351 transfer in which any of the transferred assets had a fair market basis or fair

market value of more than $1 million? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

1120

Form

(2012)

1

1 2

2 3

3 4

4 5

5