3

Form 1120 (2012)

Page

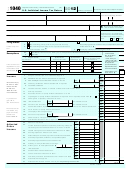

Schedule J

Tax Computation and Payment (see instructions)

Part I–Tax Computation

1

Check if the corporation is a member of a controlled group (attach Schedule O (Form 1120)) .

.

.

.

▶

2

Income tax. Check if a qualified personal service corporation (see instructions) .

.

.

.

.

.

.

.

2

▶

3

3

Alternative minimum tax (attach Form 4626) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

Add lines 2 and 3 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4

5 a

Foreign tax credit (attach Form 1118) .

.

.

.

.

.

.

.

.

.

.

.

.

.

5a

b

5b

Credit from Form 8834, line 30 (attach Form 8834) .

.

.

.

.

.

.

.

.

.

c

General business credit (attach Form 3800)

.

.

.

.

.

.

.

.

.

.

.

.

5c

d

Credit for prior year minimum tax (attach Form 8827)

.

.

.

.

.

.

.

.

.

5d

e

Bond credits from Form 8912

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

5e

6

Total credits. Add lines 5a through 5e

6

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

Subtract line 6 from line 4

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

7

8

Personal holding company tax (attach Schedule PH (Form 1120)) .

.

.

.

.

.

.

.

.

.

.

.

.

.

8

9 a

9a

Recapture of investment credit (attach Form 4255) .

.

.

.

.

.

.

.

.

.

b

Recapture of low-income housing credit (attach Form 8611)

.

.

.

.

.

.

.

9b

c

Interest due under the look-back method—completed long-term contracts (attach

9c

Form 8697) .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

d

Interest due under the look-back method—income forecast method (attach Form

8866)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

9d

e

Alternative tax on qualifying shipping activities (attach Form 8902)

.

.

.

.

.

9e

f

9f

Other (see instructions—attach statement)

.

.

.

.

.

.

.

.

.

.

.

.

10

Total. Add lines 9a through 9f .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

10

11

Total tax. Add lines 7, 8, and 10. Enter here and on page 1, line 31 .

.

.

.

.

.

.

.

.

.

.

.

.

11

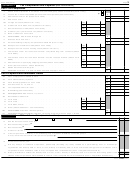

Part II–Payments and Refundable Credits

12

2011 overpayment credited to 2012

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

12

13

2012 estimated tax payments

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

13

14

14 (

2012 refund applied for on Form 4466 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

)

15

Combine lines 12, 13, and 14

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

15

16

Tax deposited with Form 7004 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

16

17

Withholding (see instructions)

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

17

18

Total payments. Add lines 15, 16, and 17 .

18

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19

Refundable credits from:

a

Form 2439 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19a

b

19b

Form 4136 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

c

Form 8827, line 8c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

19c

d

Other (attach statement—see instructions).

.

.

.

.

.

.

.

.

.

.

.

.

19d

20

Total credits. Add lines 19a through 19d .

20

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

21

Total payments and credits. Add lines 18 and 20. Enter here and on page 1, line 32 .

.

.

.

.

.

.

.

21

Schedule K

Other Information (see instructions)

Other (specify)

1

Check accounting method: a

Cash

b

Accrual

c

▶

Yes

No

2

See the instructions and enter the:

Business activity code no.

a

▶

Business activity

b

▶

Product or service

c

▶

3

Is the corporation a subsidiary in an affiliated group or a parent-subsidiary controlled group?

.

.

.

.

.

.

.

.

.

.

If “Yes,” enter name and EIN of the parent corporation

▶

4

At the end of the tax year:

a

Did any foreign or domestic corporation, partnership (including any entity treated as a partnership), trust, or tax-exempt

organization own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all classes of the

corporation’s stock entitled to vote? If "Yes," complete Part I of Schedule G (Form 1120) (attach Schedule G) .

.

.

.

.

.

b

Did any individual or estate own directly 20% or more, or own, directly or indirectly, 50% or more of the total voting power of all

classes of the corporation’s stock entitled to vote? If "Yes," complete Part II of Schedule G (Form 1120) (attach Schedule G)

.

1120

Form

(2012)

1

1 2

2 3

3 4

4 5

5