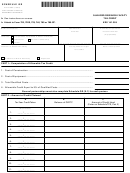

Schedule Verb - Voluntary Environmental Remediation Tax Credit Page 2

ADVERTISEMENT

41A720VERB (10-12)

Page 2

INSTRUCTIONS—VOLUNTARY ENVIRONMENTAL

Commonwealth of Kentucky

REMEDIATION TAX CREDIT

DEPARTMENT OF REVENUE

The Voluntary Environmental Remediation Tax Credit is applied against the individual income tax imposed by KRS 141.020,

the corporation income tax imposed by KRS 141.040 and the limited liability entity tax (LLET) imposed by KRS 141.0401. The

amount of credit claimed against the corporation income tax and the LLET can be different.

The amount of credit claimed from Part I, Line 3 and the resulting balance of credit available must be calculated separately

for income tax and the LLET. If the balance available for the income tax or the LLET reaches zero, no further credit is allowed

against that tax liability. For example, any balance available for income tax cannot be used as a credit against the LLET nor can

any balance available for the LLET be used as a credit against the income tax liability.

Purpose of Schedule—This schedule is used by taxpayers subject to the taxes under KRS 141.020, KRS 141.040 or

KRS 141.0401 to claim a credit for expenditures made for a qualifying voluntary environmental remediation property.

“Qualifying voluntary environmental remediation property” means real property subject to the provisions of KRS 224.01-400,

KRS 224.01-405 or KRS 224.60-135 where the Kentucky Energy and Environment Cabinet has made a determination that the

property meets the requirements provided by KRS 141.418(1)(e).

A taxpayer claiming a credit as provided by KRS 141.418 shall submit receipts to the Kentucky Energy and Environment Cabinet

as proof of the expenditures claimed. The Kentucky Energy and Environment Cabinet shall verify the receipts. After the receipts

are verified, the Department of Revenue shall notify the taxpayer of eligibility for the credit. KRS 141.418(5)

The credit is on a dollar-per-dollar basis up to a maximum of $150,000 in approved expenditures. The amount of the allowable

credit for any taxable year is limited to 25 percent of the maximum credit approved (Part I, Line 2), and it may be carried forward

ten (10) years. The taxpayer is eligible to claim the credit on the tax return in the taxable year the credit was certified.

General Instructions—If the entity type is not listed, check the “Other” box and list the entity type.

Part I — Computation of Allowable Tax Credit

This will be completed by the Department of Revenue and mailed to the taxpayer.

Line 1—This is the date the credit is certified by the Kentucky Energy and Environment Cabinet.

Line 2—This is the amount of expenditures certified by the Kentucky Energy and Environment Cabinet.

Line 3—This is the maximum amount of credit allowed for any one taxable year.

Part II — Taxpayer’s Certification

The taxpayer or the taxpayer’s representative must certify that the expenditures incurred at the qualifying voluntary

environmental remediation property were not financed through a public grant program or the petroleum storage tank

environmental assurance fund.

The certification shall be completed and a copy of Schedule VERB shall be attached to the applicable tax return each year that

a taxpayer claims the voluntary environmental remediation tax credit against the tax imposed by KRS 141.020 or 141.040 and

KRS 141.0401.

Part III — Current Year Credit

Line 1—LLET Credit—Enter the amount of current year credit claimed against the LLET. This credit cannot reduce the LLET

below the $175 minimum.

Line 2—Corporation Income Tax Credit—Enter the amount of the current year credit claimed against the corporation income

tax.

Line 3—Individual Income Tax Credit—Enter the amount of the current year credit claimed against the individual income tax.

A pass-through entity shall include on each Schedule K-1 the partner’s, member’s or shareholder’s pro rata share of the

approved credit.

Part IV — Amount of Credit Claimed

This will be completed by the taxpayer and used as a tracking schedule for the credit taken.

Column A—Enter the month and year the tax credit is taken for this project.

Column B—Enter for year 1 the allowable credit from Part I, Line 2. Enter for each succeeding year the difference between

Column B and Column C for the LLET and income tax.

Column C—Enter the amount of credit used for that year. If the amount is zero, enter zero (-0-).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2