Instructions For Pa-20s/pa 65 Schedule D - Sale, Exchange Or Disposition Of Property - 2012 Page 4

ADVERTISEMENT

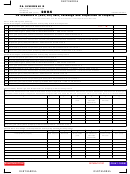

Date Sold

Sale, Exchange or Disposition of

Completing

Property Outside Pennsylvania.

Enter the date (MMDDYYY) the

property was sold.

PA Schedule D-II

Business Name

PA Allowed or Allowable

Enter the complete name of the

Copy PA-20S/PA-65 Schedule D-II to

entity or business as shown on the

Depreciation

list additional properties.

PA-20S/PA-65 Information Return.

Enter your Pennsylvania-allowed or

allowable depreciation from your

Sale, Exchange or

FEIN

books and records.

Disposition of Property

Enter the 9-digit federal employer

within Pennsylvania

identification number (FEIN) of the

Gross Sales Price

entity or business as shown on the

On PA-20S/PA-65 Schedule D-II,

Enter the gross sales price of the

PA-20S/PA-65 Information Return.

enter the allocated gain (loss) from

property.

the sale, exchange or disposition of

property within Pennsylvania,

Cost or Other PA Basis

Fill In the

included on federal Schedule K line

Enter your cost or other Pennsylvania

amounts.

Applicable Ovals

basis from your books and records.

Enter whole dollars only. If this is

an amended schedule, fill in the oval.

Difference Between

Amended Schedule

If Part II is blank, fill in the oval.

PA/Federal Gain (Loss)

If this is an amended schedule, fill in

The entity must take the gross sales

the oval.

Business Name

price, less cost or other Pennsylvania

Enter the complete name of the

basis, less Pennsylvania-allowed or

If Part III is Blank

entity or business as shown on the

allowable depreciation, to obtain the

If there is no difference in the gain

PA-20S/PA-65 Information Return.

Pennsylvania gain (loss).

(loss) on the federal return and the

Pennsylvania gain (loss) minus

gain (loss) on the PA-20S/PA-65

FEIN

federal gain (loss) equals the

Information Return then PA Schedule

Enter the nine-digit federal employer

difference between Pennsylvania/

D-III should be blank. Fill in the oval.

identification number (FEIN) of the

federal gain (loss).

entity or business as shown on the

If any of the federal gain (loss)

PA-20S/PA-65 Information Return.

Line Instructions

transactions require adjustment, list

each transaction and show the

differences in federal gain (loss).

Fill In the

Line 1

If the difference is negative, fill in

All Outside PA Gain (Loss)

Applicable Ovals

the loss oval.

Included in Ordinary Business

The sum of all differences in

Income (Loss)

Pennsylvania/federal gain (loss)

Amended Schedule

Enter the amount reported on PA-

fields must equal the amount

If this is an amended schedule, fill in

reported on the PA-20S/PA-65

20S/PA-65 Schedule M, Part A, Line

the oval.

Schedule D-II, Line 13.

1 and Line 11, Column (e) (Outside

Pennsylvania gain (loss) only).

If Part II is Blank

Completing

If there is no difference in the gain

Note.

On the PA-20S/PA-65

(loss) on the federal return and the

Schedule D, the sum of Part

PA Schedule D-III

gain (loss) on the PA-20S/PA-65

I, Line 1 and Part III, Line 1

Information Return, PA Schedule

will equal the amount reported on

D-II should be blank. Fill in the oval.

Allocated Gain (Loss) from

PA-20S/PA-65 Schedule M, Part A,

the Sale, Exchange or

Line 1 and Line 11, Column (e).

Disposition of Property

Line Instructions

Outside Pennsylvania

Line 2

On PA-20S/PA-65 Schedule D-III,

Lines 1 through 5

enter the allocated gain (loss) from

All Outside PA Gain (Loss)

sale, exchange or disposition of

Included in Ordinary Net

Type of Property

property outside Pennsylvania. Enter

Rental/Royalty Income (Loss)

Enter one of the following codes for

whole dollars only. If this is an

from Federal Form 8825

type of property and include a

amended schedule, fill in the oval. If

Enter the amounts reported on PA-

description of the property.

Part III is blank, fill in the oval.

20S/PA-65 Schedule M, Part A, Lines

2, 3, and 6, Column (e) (Outside

R = Real

S = Security

Note.

The gain (loss) from

Pennsylvania gain (loss) only).

P = Personal

O = Other Intangible

the sale or disposition of an

(not security)

intangible asset is not

Note.

On the PA-20S/PA-65

Pennsylvania-source for nonresidents

Schedule D, the sum of Part

Date Acquired

unless employed in a Pennsylvania

I, Line 2 and Part III, Line 2

Enter the date (MMDDYYY) the

trade or business. See PIT Bulletin

will equal the amounts reported on

property was acquired.

2005-02. This gain (loss) is reported

PA-20S/PA-65 Schedule M, Part A,

on PA-20S/PA-65 Schedule D-III,

Lines 2, 3 and 6, Column (e).

- 4 -

Instructions for PA-20S/PA 65 Schedule D

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6