Instructions For Pa-20s/pa 65 Schedule D - Sale, Exchange Or Disposition Of Property - 2012 Page 5

ADVERTISEMENT

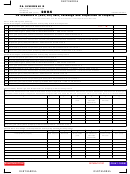

Line 3

will equal the amount reported on

Line 12

the PA-20S/PA-65 Schedule M, Part

All Outside PA Net Short-Term

Outside PA PIT Reportable

A, Line 9, Column (e).

Capital Gain (Loss) from

Schedule D Gain (Loss) Before

Federal Schedule D

Pennsylvania Personal Income

Line 7

Enter the amount reported on PA-

Tax Adjustments

Capital Gains Distributions

20S/PA-65 Schedule M, Part A, Line

Enter the difference of Line 10 minus

Taxed as Dividends

7, Column (a) (Outside Pennsylvania

Line 11.

Enter the amounts reported on PA-

gain (loss) only).

20S/PA-65 Schedule M, Part A, Lines

Line 13

7 and 8, Column (d).

Note.

On the PA-20S/PA-65

Net or Aggregate Outside PA

Schedule D, the sum of Part

PIT Adjustments for Schedule D

I, Line 3 and Part III, Line 3

Line 8

will equal the amount reported on

Gain (Loss) from Transactions

Total Federal-Realized and

the PA-20S/PA-65 Schedule M, Part

Requiring Adjustment for

Recognized Outside PA-Source

A, Line 7, Column (a).

PA/Federal Gain (Loss)

Reportable Gain (Loss) Before

Differences. Itemize in Part IV

Classification and/or

of this Schedule

Line 4

Adjustment Amounts for PA PIT

Full detail must be provided on PA-

Purposes

All Outside PA Net Long-Term

20S/PA-65 Schedule D-IV when there

Add Lines 1 through 6, minus Line 7.

Capital Gain (Loss) from

is a difference between federal and

Enter the result on Line 8.

Federal Schedule D

PA gain (loss) for assets disposed.

Enter the amount reported on PA-

Enter the sum of the aggregate

20S/PA-65 Schedule M, Part A, Line

difference on this line. Include any

Line 9

8, Column (a) (Outside Pennsylvania

other difference in gain, e.g., an

Outside PA Gain (Loss) on

gain (loss) only).

installment sale, on this line, and

Federal Non-Taxable Exchanges

itemize on PA-20S/PA-65 Schedule

on IRC Sections 1031 and 1033

Note.

D-IV. If there is no difference

On the PA-20S/PA-65

Enter the outside Pennsylvania

between Pennsylvania/federal gain

Schedule D, the sum of Part I,

amount from federal Form 8824,

(loss) for assets disposed, fill in the

Line 4 and Part III, Line 4 will equal

like-kind exchanges. Pennsylvania

“blank” oval on PA-20S/PA-65

the amount reported on the PA-

does not recognize like-kind

Schedule D-IV.

20S/PA-65 Schedule M, Part A, Line

exchanges under IRC Sections 1031

Assets on which federal bonus

8, Column (a).

and 1033. Report federal deferred

depreciation was taken and disposed

gain (loss) on this line.

in the current year may have a

Line 5

difference between federal and

Pennsylvania gain (loss).

All Other Outside PA Net IRC §

Line 10

1231 Gain (Loss) Reported on

Total Outside PA/Federal Gain

Federal Form 4797 Not Listed

Line 14

(Loss) Reportable for PA PIT

Above

Before Additional Classification

Net Adjustment to Arrive at

Enter the amount reported on PA-

and/or Adjustments

Outside PA PIT Schedule D

20S/PA-65 Schedule M, Part A, Line

Enter the sum of Lines 8 and 9.

Reportable Gain (Loss)

10, Column (e) (Outside

Enter the sum of Lines 12 and 13.

Pennsylvania gain (loss) only).

Line 11

Note.

On the PA-20S/PA-65

Line 15

Outside PA Adjustment for Gain

Schedule D, the sum of Part

Outside Partnership and PA S

(Loss) Reflected on PA-

I, Line 5 and Part III, Line 5

Corporation Gain (Loss) from

will equal the amount reported on

20S/PA-65 Schedule M, Part A,

PA-20S/PA-65 Schedules RK-1

the PA-20S/PA-65 Schedule M, Part

for Business Income (Loss)

and NRK-1

A, Line 10, Column (e).

(Net Profits from a Business,

Enter the amount of outside

Profession or Farm)

Pennsylvania gain (loss) from pass

Enter the amounts reported on PA-

Line 6

through entities.

20S/PA-65 Schedule M, Part A, Lines

All Outside PA Gain (Loss) from

7 and 8, Column (b) (Outside

the Disposition of IRC § 179

Pennsylvania gain (loss) only).

Line 16

Property

Total Outside PA-20S/PA-65

Enter the amount reported on PA-

Note.

If the proceeds from

Schedule D Net Gain (loss)

20S/PA-65 Schedule M, Part A, Line

assets sold have been

from Property Outside PA

9, Column (e) (Outside Pennsylvania

reinvested back into the

Enter the sum of Lines 14 and 15.

gain (loss) only).

business operations and the business

Also enter this amount on the PA-

has the same North American

20S/PA-65 Information Return, Part

Note.

On the PA-20S/PA-65

Industry Classification System code,

III, Line 5a.

then the gain (loss) should be

Schedule D, the sum of Part

reflected as ordinary income.

I, Line 6 and Part III, Line 6

Instructions for PA-20S/PA 65 Schedule D

- 5 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6