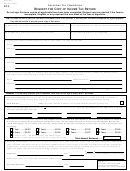

instructions for form 2696

Request for approval for a Computerized tax Roll by a local Unit

As amended 2002 Act 505

and TV, adjusted SEV and TV, taxes spread and adjusted

Lines not listed here require no explanation.

tax spreads are correctly recorded in the settlement roll.

PART 1: Precollection Tax Roll.

Copies of the printouts required for lines 3 and 4 could be

Line 1. Please submit copies of two pages from the tax roll

the documentation required by line 9.

and a copy of the assessor’s warrant. One page of the tax

The treasurer’s certificate, assessor warrant and line 9

roll should show metes and bounds descriptions; the second

documentation must be attached to the computer-printed

page, platted subdivision descriptions. Both pages must show

settlement roll or included with an electronic settlement roll

the spread of taxes. An additional page must be submitted

when tendered to the County Treasurer.

that depicts a special assessment when a special assessment

PART 4: Procedures and Requirements.

is not listed on one of the other precollection tax roll pages.

Line 10. The daily collections must be deposited intact. If,

PART 2: Tax Roll Changes.

for major reasons, the deposit cannot be made daily, separate

Line 3. The example must include the split of a metes

deposits for each day’s tax collections, equaling the amount

and bounds description and include the parcel code(s), the

of that day’s actual collections that are recorded in the tax

original and prorated SEV and TV, and tax spreads for the

receipts journal must be made and tendered to the bank. This

split descriptions.

will result in each deposit being listed as separate items on

Line 4. The computer printout must include the parcel

the bank statement.

number, description, Tax Tribunal docket number, State Tax

Line 12. The description of security procedures should

Commission identification, date of ruling, board of review

address the procedures you have implemented that will

meeting identification (date, etc.), original and adjusted SEV

safeguard the data in the computer from loss due to fire or

and TV and adjusted tax spread.

power failure, unauthorized access or changing and updating

data, how data will be reestablished if destroyed by fire or

PART 3: Settlement Tax Roll.

power failure, ability to discover unauthorized changes or

Line 5. The example of the settlement roll must illustrate

posting (updating) and backup off-site storage.

the posting of the tax receipts or transaction number, date of

payment and partial payment validation with unpaid balance

Line 14. Describe the other procedure you have implemented

listed on the settlement roll for collecting partial payment.

that will allow public viewing of the posted (current updated)

(Any one or more taxes [school, county, etc.] plus fees and/

tax collection roll.

or penalty undivided interest etc., as applicable.)

Please call or write the office listed below if you have any

Lines 6 through 9. The collecting treasurer’s certificate

questions regarding the use of the computerized database

(Line 7) must certify that all tax collections are posted in

as the tax roll or completing the application for approval.

the settlement roll with the tax receipt or transaction number

Michigan Department of Treasury

or numbers for payment or partial payments, the balance of

State Tax Commission

unpaid taxes and date(s) paid listed in the settlement roll

PO Box 30471

adjacent to the description and spread of taxes.

Lansing, MI 48909-7971

The assessor’s warrant must certify that the original SEV

517-335-3429

1

1 2

2 3

3