For additional information, contact the Taxpayer Services Division in one of our Department of Revenue Offices:

Chattanooga

Jackson

Johnson City

Knoxville

Memphis

Nashville

(731) 423-5747

(423) 854-5321

(901) 213-1400

(615) 253-0600

(423) 634-6266

(865) 594-6100

Suite 350

Suite 340

204 High Point Drive

Room 606

3150 Appling Road

3rd Floor

Lowell Thomas Building

Bartlett, TN

Andrew Jackson Building

State Office Building

State Office Building

540 McCallie Avenue

225 Martin Luther King Blvd.

531 Henley Street

500 Deaderick Street

Tennessee residents can also call our statewide toll free number at 1-800-342-1003.

Out-of-state callers must dial (615) 253-0600.

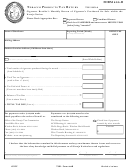

INSTRUCTIONS FOR COMPLETION OF PETROLEUM PRODUCTS TRANSPORTER RETURN

GENERAL INFORMATION

Section 67-3-704 provides that a person licensed as a transporter in this state shall file monthly returns with the department, reporting the

amount of taxable petroleum products transported within or across the borders of this state; provided that transport truck operations

exclusively within the state are not reportable except when transport operations originate at a refinery in this state. The return shall be filed

within twenty-five (25) days after the end of the month in which delivery was made.

If a transporter fails to make the reports required by this section, the commissioner may assess a civil penalty of one thousand dollars

($1,000) for each violation.

GENERAL INFORMATION - SCHEDULE OF DELIVERIES

TRANSPORTER SCHEDULE OF DELIVERIES - Enter number of net gallons for each product disbursed from the terminal. The schedule

should include the name and FEIN of the person hiring the carrier, the name and the FEIN of the supplier (the company from whose account

the fuel was withdrawn at the terminal), the name and address of the customer receiving delivery, the origin (may use terminal code), the

date and point of delivery, the document number, the type of product, and the gallons. Barge companies should enter the name of the tow

in the mode column.

INSTRUCTIONS

Line 1

Total net gallons loaded at a Tennessee terminal, bulk plant, or refinery and delivered to another state - Enter the number of

gallons loaded at a Tennessee terminal, bulk plant, or refinery and exported to another state.

Line 2

Total net gallons product loaded at an out-of-state terminal, bulk plant, or refinery and delivered in Tennessee - Enter the

number of gallons loaded at an out-of-state terminal, bulk plant, or refinery and imported into Tennessee.

Line 3

Total net gallons product loaded at a Tennessee refinery and delivered in Tennessee - Enter the number of gallons loaded at

a Tennessee refinery and delivered in Tennessee.

Line 4

Total gallons of petroleum product transported - Add lines 1 through 3.

INTERNET (4-05)

1

1 2

2