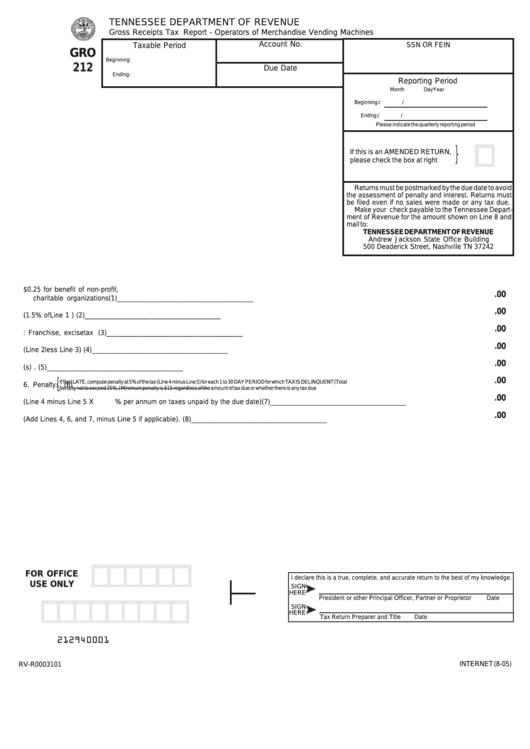

TENNESSEE DEPARTMENT OF REVENUE

Gross Receipts Tax Report - Operators of Merchandise Vending Machines

Account No.

Taxable Period

SSN OR FEIN

GRO

Beginning:

212

Due Date

Ending:

Reporting Period

Month

Day

Year

Beginning:

/

/

Ending:

/

/

Please indicate the quarterly reporting period

}

If this is an AMENDED RETURN,

please check the box at right

Returns must be postmarked by the due date to avoid

the assessment of penalty and interest. Returns must

be filed even if no sales were made or any tax due.

Make your check payable to the Tennessee Depart-

ment of Revenue for the amount shown on Line 8 and

mail to:

TENNESSEE DEPARTMENT OF REVENUE

Andrew Jackson State Office Building

500 Deaderick Street, Nashville TN 37242

1. Gross receipts on vending machines that dispense products for $0.25 for benefit of non-profit,

.00

charitable organizations .................................................................................................................................. (1)

___________________________________

.00

2. Tax (1.5% of Line 1 ) ...................................................................................................................................... (2)

___________________________________

.00

3. Less: Franchise, excise tax credit ................................................................................................................. (3)

___________________________________

.00

4. Net tax (Line 2 less Line 3) ............................................................................................................................. (4)

___________________________________

.00

5. Credit amount from previous Department of Revenue notice(s) ................................................................... (5)

___________________________________

.00

{

If filed LATE, compute penalty at 5% of the tax (Line 4 minus Line 5) for each 1 to 30 DAY PERIOD for which TAX IS DELINQUENT (Total

6. Penalty

... (6)

___________________________________

penalty not to exceed 25%.) Minimum penalty is $15 regardless of the amount of tax due or whether there is any tax due

.00

7. Interest (Line 4 minus Line 5 X

% per annum on taxes unpaid by the due date) ............................... (7)

___________________________________

.00

8. Total Amount Due (Add Lines 4, 6, and 7, minus Line 5 if applicable) .......................................................... (8)

___________________________________

FOR OFFICE

I declare this is a true, complete, and accurate return to the best of my knowledge.

USE ONLY

SIGN

HERE

President or other Principal Officer, Partner or Proprietor

Date

SIGN

HERE

Tax Return Preparer and Title

Date

212940001

RV-R0003101

INTERNET (8-05)

1

1 2

2