Form Mt-171 - Waste Tire Management Fee Exempt Purchase Certificate

ADVERTISEMENT

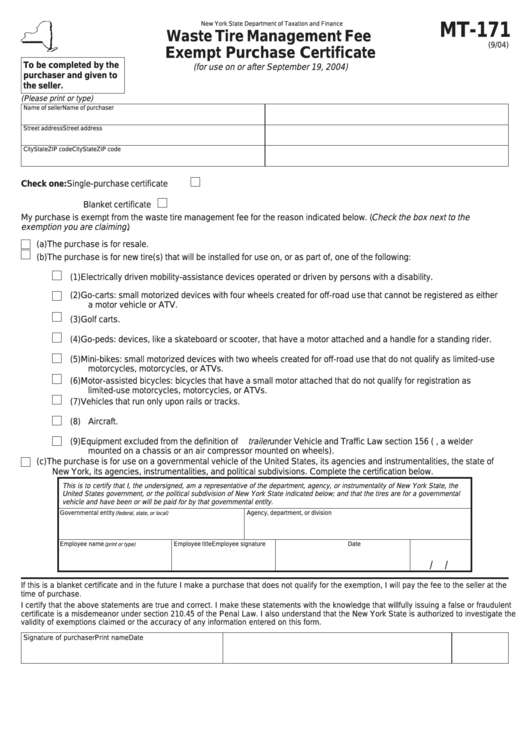

New York State Department of Taxation and Finance

MT-171

Waste Tire Management Fee

(9/04)

Exempt Purchase Certificate

To be completed by the

(for use on or after September 19, 2004)

purchaser and given to

the seller.

(Please print or type)

Name of seller

Name of purchaser

Street address

Street address

City

State

ZIP code

City

State

ZIP code

Check one:

Single-purchase certificate

Blanket certificate

My purchase is exempt from the waste tire management fee for the reason indicated below. ( Check the box next to the

exemption you are claiming. )

(a) The purchase is for resale.

(b) The purchase is for new tire(s) that will be installed for use on, or as part of, one of the following:

(1) Electrically driven mobility-assistance devices operated or driven by persons with a disability.

(2) Go-carts: small motorized devices with four wheels created for off-road use that cannot be registered as either

a motor vehicle or ATV.

(3) Golf carts.

(4) Go-peds: devices, like a skateboard or scooter, that have a motor attached and a handle for a standing rider.

(5) Mini-bikes: small motorized devices with two wheels created for off-road use that do not qualify as limited-use

motorcycles, motorcycles, or ATVs.

(6) Motor-assisted bicycles: bicycles that have a small motor attached that do not qualify for registration as

limited-use motorcycles, motorcycles, or ATVs.

(7) Vehicles that run only upon rails or tracks.

(8) Aircraft.

(9) Equipment excluded from the definition of trailer under Vehicle and Traffic Law section 156 (e.g., a welder

mounted on a chassis or an air compressor mounted on wheels).

(c) The purchase is for use on a governmental vehicle of the United States, its agencies and instrumentalities, the state of

New York, its agencies, instrumentalities, and political subdivisions. Complete the certification below.

This is to certify that I, the undersigned, am a representative of the department, agency, or instrumentality of New York State, the

United States government, or the political subdivision of New York State indicated below; and that the tires are for a governmental

vehicle and have been or will be paid for by that governmental entity.

Governmental entity

Agency, department, or division

(federal, state, or local)

Employee name

Employee title

Employee signature

Date

(print or type)

/

/

If this is a blanket certificate and in the future I make a purchase that does not qualify for the exemption, I will pay the fee to the seller at the

time of purchase.

I certify that the above statements are true and correct. I make these statements with the knowledge that willfully issuing a false or fraudulent

certificate is a misdemeanor under section 210.45 of the Penal Law. I also understand that the New York State is authorized to investigate the

validity of exemptions claimed or the accuracy of any information entered on this form.

Signature of purchaser

Print name

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2