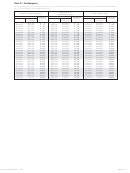

Table B - Tax Calculation for 2012 Taxable Year

Use the fi ling status you expect to report on your 2012 tax return. This initial tax calculation does not include personal tax credits,

3% phase-out add-back, or tax recapture.

Single or Filing Separately - If the amount on the Tax Calculation Schedule, Line 3 is:

Less than or equal to: ......................................................... $ 10,000 ...................... 3.00%

More than $10,000, but less than or equal to ..................... $ 50,000 ...................... $300 plus 5.0% of the excess over $10,000

More than $50,000, but less than or equal to ..................... $100,000 ..................... $2,300 plus 5.5% of the excess over $50,000

More than $100,000, but less than or equal to ................... $200,000 ..................... $5,050 plus 6.0% of the excess over $100,000

More than $200,000, but less than or equal to ................... $250,000 ..................... $11,050 plus 6.5% of the excess over $200,000

More than $250,000 ................................................................................................ $14,300 plus 6.7% of the excess over $250,000

Single or Filing Separately Examples:

Line 3 is $525,000, Line 4 is $32,725

Line 3 is $13,000, Line 4 is $450

$525,000 - $250,000

=

$275,000

$13,000 - $10,000

=

$3,000

$275,000 x .067

=

$18,425

$3,000 X .05

=

$150

$14,300 + $18,425

=

$32,725

$300 + $150

=

$450

Filing Jointly/Qualifying Widow(er) - If the amount on the Tax Calculation Schedule, Line 3 is:

Less than or equal to: ......................................................... $ 20,000 ...................... 3.00%

More than $20,000, but less than or equal to ..................... $100,000 ..................... $600 plus 5.0% of the excess over $20,000

More than $100,000, but less than or equal to ................... $200,000 ..................... $4,600 plus 5.5% of the excess over $100,000

More than $200,000, but less than or equal to ................... $400,000 ..................... $10,100 plus 6.0% of the excess over $200,000

More than $400,000, but less than or equal to ................... $500,000 ..................... $22,100 plus 6.5% of the excess over $400,000

More than $500,000 ................................................................................................ $28,600 plus 6.7% of the excess over $500,000

Filing Jointly/Qualifying Widow(er) Examples:

Line 3 is $22,500, Line 4 is $725

Line 3 is $1,100,000, Line 4 is $68,800

$22,500 - $20,000

=

$2,500

$1,100,000 - $500,000

=

$600,000

$2,500 x .05

=

$125

$600,000 x .067

=

$40,200

$600 + $125

=

$725

$28,600 + $40,200

=

$68,800

Head of Household - If the amount on the Tax Calculation Schedule, Line 3 is:

Less than or equal to: ......................................................... $ 16,000 ...................... 3.00%

More than $16,000, but less than or equal to ..................... $ 80,000 ...................... $480 plus 5.0% of the excess over $16,000

More than $80,000, but less than or equal to ..................... $160,000 ..................... $3,680 plus 5.5% of the excess over $80,000

More than $160,000, but less than or equal to ................... $320,000 ..................... $8,080 plus 6.0% of the excess over $160,000

More than $320,000, but less than or equal to ................... $400,000 ..................... $17,680 plus 6.5% of the excess over $320,000

More than $400,000 ................................................................................................ $22,880 plus 6.7% of the excess over $400,000

Head of Household Examples:

Line 3 is $825,000, Line 4 is $51,355

Line 3 is $20,000, Line 4 is $680

$825,000 - $400,000

=

$425,000

$20,000 - $16,000

=

$4,000

$425,000 x .067

=

$28,475

$4,000 x .05

=

$200

$22,880 + $28,475

=

$51,355

$480 + $200

=

$680

Table C - 3% Phase-Out Add-Back

Use the fi ling status you expect to report on your 2012 tax return and your Connecticut AGI * (Tax Calculation Schedule, Line 1)

to determine your phase-out amount.

Filing Jointly or

Single

Filing Separately

Head of Household

Qualifi ed Widow(er)

Connecticut AGI*

Connecticut AGI*

Connecticut AGI*

Connecticut AGI*

3%

3%

3%

3%

More Than Less Than Phase-Out More Than Less Than Phase-Out More Than Less Than Phase-Out More Than Less Than Phase-Out

or Equal To Add-Back

or Equal To Add-Back

or Equal To Add-Back

or Equal To Add-Back

$

0

$ 56,500

$

0

$

0

$100,500

$

0

$

0

$50,250

$

0

$

0

$ 78,500

$

0

$ 56,500

$ 61,500

$ 20

$100,500

$105,500

$ 40

$50,250

$52,750

$ 20

$ 78,500

$ 82,500

$ 32

$ 61,500

$ 66,500

$ 40

$105,500

$110,500

$ 80

$52,750

$55,250

$ 40

$ 82,500

$ 86,500

$ 64

$ 66,500

$ 71,500

$ 60

$110,500

$115,500

$120

$55,250

$57,750

$ 60

$ 86,500

$ 90,500

$ 96

$ 71,500

$ 76,500

$ 80

$115,500

$120,500

$160

$57,750

$60,250

$ 80

$ 90,500

$ 94,500

$128

$ 76,500

$ 81,500

$100

$120,500

$125,500

$200

$60,250

$62,750

$100

$ 94,500

$ 98,500

$160

$ 81,500

$ 86,500

$120

$125,500

$130,500

$240

$62,750

$65,250

$120

$ 98,500

$102,500

$192

$ 86,500

$ 91,500

$140

$130,500

$135,500

$280

$65,250

$67,750

$140

$102,500

$106,500

$224

$ 91,500

$ 96,500

$160

$135,500

$140,500

$320

$67,750

$70,250

$160

$106,500

$110,500

$256

$ 96,500

$101,500

$180

$140,500

$145,500

$360

$70,250

$72,750

$180

$110,500

$114,500

$288

$101,500

and up

$200

$145,500

and up

$400

$72,750

and up

$200

$114,500

and up

$320

* Form CT-1040NR/PY fi lers must use income from Connecticut sources if it exceeds Connecticut adjusted gross income.

Form CT-1040ES (Rev. 1/12)

Page 4 of 6

1

1 2

2 3

3 4

4 5

5 6

6