Form CT-1040ES (Rev. 1/12)

Page 6 of 6

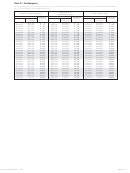

Table E - Personal Tax Credits for 2012 Taxable Year

Use the fi ling status you expect to report on your 2012 tax return and your Connecticut AGI * (Tax Calculation Schedule,

Line 1) to determine your decimal amount.

Filing Jointly or

Single

Filing Separately

Head of Household

Qualifi ed Widow(er)

Connecticut AGI*

Connecticut AGI*

Connecticut AGI*

Connecticut AGI*

Decimal

Decimal

Decimal

Decimal

More Than Less Than

Amount More Than Less Than

Amount More Than Less Than

Amount More Than Less Than

Amount

or Equal To

or Equal To

or Equal To

or Equal To

$13,500

$16,900

.75

$24,000

$30,000

.75

$12,000

$15,000

.75

$19,000

$24,000

.75

$16,900

$17,400

.70

$30,000

$30,500

.70

$15,000

$15,500

.70

$24,000

$24,500

.70

$17,400

$17,900

.65

$30,500

$31,000

.65

$15,500

$16,000

.65

$24,500

$25,000

.65

$17,900

$18,400

.60

$31,000

$31,500

.60

$16,000

$16,500

.60

$25,000

$25,500

.60

$18,400

$18,900

.55

$31,500

$32,000

.55

$16,500

$17,000

.55

$25,500

$26,000

.55

$18,900

$19,400

.50

$32,000

$32,500

.50

$17,000

$17,500

.50

$26,000

$26,500

.50

$19,400

$19,900

.45

$32,500

$33,000

.45

$17,500

$18,000

.45

$26,500

$27,000

.45

$19,900

$20,400

.40

$33,000

$33,500

.40

$18,000

$18,500

.40

$27,000

$27,500

.40

$20,400

$22,500

.35

$33,500

$40,000

.35

$18,500

$20,000

.35

$27,500

$34,000

.35

$22,500

$23,000

.30

$40,000

$40,500

.30

$20,000

$20,500

.30

$34,000

$34,500

.30

$23,000

$23,500

.25

$40,500

$41,000

.25

$20,500

$21,000

.25

$34,500

$35,000

.25

$23,500

$24,000

.20

$41,000

$41,500

.20

$21,000

$21,500

.20

$35,000

$35,500

.20

$24,000

$28,100

.15

$41,500

$50,000

.15

$21,500

$25,000

.15

$35,500

$44,000

.15

$28,100

$28,600

.14

$50,000

$50,500

.14

$25,000

$25,500

.14

$44,000

$44,500

.14

$28,600

$29,100

.13

$50,500

$51,000

.13

$25,500

$26,000

.13

$44,500

$45,000

.13

$29,100

$29,600

.12

$51,000

$51,500

.12

$26,000

$26,500

.12

$45,000

$45,500

.12

$29,600

$30,100

.11

$51,500

$52,000

.11

$26,500

$27,000

.11

$45,500

$46,000

.11

$30,100

$54,000

.10

$52,000

$96,000

.10

$27,000

$48,000

.10

$46,000

$74,000

.10

$54,000

$54,500

.09

$96,000

$96,500

.09

$48,000

$48,500

.09

$74,000

$74,500

.09

$54,500

$55,000

.08

$96,500

$97,000

.08

$48,500

$49,000

.08

$74,500

$75,000

.08

$55,000

$55,500

.07

$97,000

$97,500

.07

$49,000

$49,500

.07

$75,000

$75,500

.07

$55,500

$56,000

.06

$97,500

$98,000

.06

$49,500

$50,000

.06

$75,500

$76,000

.06

$56,000

$56,500

.05

$98,000

$98,500

.05

$50,000

$50,500

.05

$76,000

$76,500

.05

$56,500

$57,000

.04

$98,500

$99,000

.04

$50,500

$51,000

.04

$76,500

$77,000

.04

$57,000

$57,500

.03

$99,000

$99,500

.03

$51,000

$51,500

.03

$77,000

$77,500

.03

$57,500

$58,000

.02

$99,500

$100,000

.02

$51,500

$52,000

.02

$77,500

$78,000

.02

$58,000

$58,500

.01

$100,000

$100 ,500

.01

$52,000

$52,500

.01

$78,000

$78,500

.01

$58,500

and up

.00

$100,500

and up

.00

$52,500

and up

.00

$78,500

and up

.00

* Form CT-1040NR/PY fi lers must use income from Connecticut sources if it exceeds Connecticut adjusted gross income.

Payment Options: You may fi le and pay your Connecticut estimated taxes electronically using the Taxpayer Service Center (TSC) or visit our website at

and follow the prompts to make a direct payment.

You may elect to pay your estimated 2012 Connecticut income tax liability using your credit card (American Express ® , Discover ® , MasterCard ® , VISA ® ) or

comparable debit card. A convenience fee will be charged by the service provider. You will be informed of the amount of the fee and you may elect to cancel

the transaction. At the end of the transaction you will be given a confi rmation number for your records.

To Pay by Credit Card:

•

Visit: and select State Payments; or

•

Call Offi cial Payments Corporation toll-free at 800-2PAYTAX (800-272-9829) and follow the instructions. You will be asked to enter the Connecticut Jurisdiction

Code: 1777.

Do not send in Form CT-1040ES if you make your payment by credit card or debit card. Your payment will be effective on the date you make the charge.

To Pay by Mail: Make your check payable to Commissioner of Revenue Services. To ensure proper posting of your payment, write your Social Security

Number(s), optional, and “2012 Form CT-1040ES” on the front of your check. Be sure to sign your check and paper clip it to the front of your coupon. Do not

send cash. DRS may submit your check to your bank electronically.

Completing the Payment Coupon: Complete all required taxpayer identifi cation information. Enter the payment amount on Line 1 of the coupon. In determining

your payment amount, you may subtract from your installment amount any available overpayment of 2011 income tax. If you fi le this coupon, preprinted,

personalized coupons will be mailed to you for the 2012 taxable year.

.................................................................................................. Cut Here ...........................................................................................

CT-1040ES

2012

Estimated Connecticut Income Tax Payment

Your Social Security Number

Spouse’s Social Security Number

Due date

• •

• •

• •

• •

___ ___ ___ ___ ___ ___ ___ ___ ___

___ ___ ___ ___ ___ ___ ___ ___ ___

• •

• •

• •

• •

Your fi rst name and middle initial

Last name

1. Payment amount

00

Spouse’s fi rst name and middle initial

Last name

Mailing address (number and street), Apartment number, PO Box

Send completed coupon and payment to :

Department of Revenue Services

City, town, or post offi ce

State

ZIP code

PO Box 2932

Hartford CT 06104-2932

• See Payment Options above.

• Print all information. Include your spouse’s SSN, if fi ling jointly.

• Cut along dotted line and mail coupon and payment to the address printed on the coupon.

• Make your check payable to Commissioner of Revenue Services.

• DRS may submit your check to your bank electronically.

• To ensure proper posting, write your SSN(s) (optional) and “2012 Form CT-1040ES” on your check.

1

1 2

2 3

3 4

4 5

5 6

6