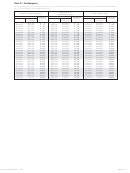

Table D - Tax Recapture

Use the fi ling status you expect to report on your 2012 tax return and your Connecticut AGI * (Tax Calculation Schedule,

Line 1) to determine your recapture amount.

Filing Jointly or

Single or Filing Separately

Head of Household

Qualifi ed Widow(er)

Connecticut AGI*

Connecticut AGI*

Connecticut AGI*

Recapture

Recapture

Recapture

More Than

Less Than

Amount

More Than

Less Than

Amount

More Than

Less Than

Amount

or Equal To

or Equal To

or Equal To

$

0

$200,000

$

0

$ 0

$400,000

$

0

$ 0

$320,000

$

0

$200,000

$205,000

$

75

$400,000

$410,000

$ 150

$320,000

$328,000

$ 120

$205,000

$210,000

$ 150

$410,000

$420,000

$ 300

$328,000

$336,000

$ 240

$210,000

$215,000

$ 225

$420,000

$430,000

$ 450

$336,000

$344,000

$ 360

$215,000

$220,000

$ 300

$430,000

$440,000

$ 600

$344,000

$352,000

$ 480

$220,000

$225,000

$ 375

$440,000

$450,000

$ 750

$352,000

$360,000

$ 600

$225,000

$230,000

$ 450

$450,000

$460,000

$ 900

$360,000

$368,000

$ 720

$230,000

$235,000

$ 525

$460,000

$470,000

$1,050

$368,000

$376,000

$ 840

$235,000

$240,000

$ 600

$470,000

$480,000

$1,200

$376,000

$384,000

$ 960

$240,000

$245,000

$ 675

$480,000

$490,000

$1,350

$384,000

$392,000

$1,080

$245,000

$250,000

$ 750

$490,000

$500,000

$1,500

$392,000

$400,000

$1,200

$250,000

$255,000

$ 825

$500,000

$510,000

$1,650

$400,000

$408,000

$1,320

$255,000

$260,000

$ 900

$510,000

$520,000

$1,800

$408,000

$416,000

$1,440

$260,000

$265,000

$ 975

$520,000

$530,000

$1,950

$416,000

$424,000

$1,560

$265,000

$270,000

$1,050

$530,000

$540,000

$2,100

$424,000

$432,000

$1,680

$270,000

$275,000

$1,125

$540,000

$550,000

$2,250

$432,000

$440,000

$1,800

$275,000

$280,000

$1,200

$550,000

$560,000

$2,400

$440,000

$448,000

$1,920

$280,000

$285,000

$1,275

$560,000

$570,000

$2,550

$448,000

$456,000

$2,040

$285,000

$290,000

$1,350

$570,000

$580,000

$2,700

$456,000

$464,000

$2,160

$290,000

$295,000

$1,425

$580,000

$590,000

$2,850

$464,000

$472,000

$2,280

$295,000

$300,000

$1,500

$590,000

$600,000

$3,000

$472,000

$480,000

$2,400

$300,000

$305,000

$1,575

$600,000

$610,000

$3,150

$480,000

$488,000

$2,520

$305,000

$310,000

$1,650

$610,000

$620,000

$3,300

$488,000

$496,000

$2,640

$310,000

$315,000

$1,725

$620,000

$630,000

$3,450

$496,000

$504,000

$2,760

$315,000

$320,000

$1,800

$630,000

$640,000

$3,600

$504,000

$512,000

$2,880

$320,000

$325,000

$1,875

$640,000

$650,000

$3,750

$512,000

$520,000

$3,000

$325,000

$330,000

$1,950

$650,000

$660,000

$3,900

$520,000

$528,000

$3,120

$330,000

$335,000

$2,025

$660,000

$670,000

$4,050

$528,000

$536,000

$3,240

$335,000

$340,000

$2,100

$670,000

$680,000

$4,200

$536,000

$544,000

$3,360

$340,000

$345,000

$2,175

$680,000

$690,000

$4,350

$544,000

$552,000

$3,480

$345,000

and up

$2,250

$690,000

and up

$4,500

$552,000

and up

$3,600

Form CT-1040ES (Rev. 1/12)

Page 5 of 6

1

1 2

2 3

3 4

4 5

5 6

6