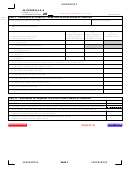

PA SCHEDULE G-S

PA-40 G-S (10-11) (FI)

PA DEPARTMENT OF REVENUE

A Pennsylvania resident can receive a credit for income tax,

4. Any other documentation from brokers, companies or

wage tax or other tax (measured by gross or net earned or

banks showing the amount of foreign interest and divi-

dend income subject to tax and foreign taxes paid.

unearned income) paid to another state or country when the

other state or country imposes its tax on income also subject

5. A copy of Federal Form 1116 if you listed interest and

to PA Personal Income Tax in the same taxable year. For

dividend income from foreign countries as “VARIOUS.” If

example, a PA resident who earns wages in Delaware, and

you submit Federal Form 1116, individual pages from bro-

pays Delaware income tax can claim a credit (subject to the

ker statements are not required. However, you must

limitations described below) for the tax imposed by Delaware

submit a statement showing the interest and dividend

on his/her compensation.

income and taxes paid on a country-by-country basis.

See the instructions for Lines 2d and 2e, Column B on

PA Schedule G-S is a shorter version of the form to claim the

Page 3.

resident credit for taxes paid to other states and countries.

Individual taxpayers are required to submit PA Schedule G-R

It is intended for use only by taxpayers who have:

in order to claim resident credit.

• Pennsylvania taxable compensation that is also subject

You may also be required at a later date to provide addition-

to tax in other states or countries. You may file more

al documentation to the Department such as (but not limit-

than one PA Schedule G-S if you have compensation

ed to) checks, money orders, foreign currency transaction

subject to tax in more than one state.

statements and other related documents in order to sub-

OR

stantiate income taxes paid or the amount of tax reported to

other states or countries as due and payable.

• Pennsylvania taxable interest or dividend income that is

also subject to tax in other countries from foreign

NOTE: If you use PA Schedule W-2S to report compensation

sources. For example, you can have interest and divi-

and you claim a resident credit for taxes paid to other states

dends taxable to Germany and be eligible to file PA

or countries on compensation, you must include copies of

any Forms W-2 for the compensation subject to tax in the

Schedule G-S, but not if the interest and dividends were

other states or countries.

taxable to Delaware. See the instructions below for Lines

2d and 2e, Column B, for more information.

CAUTIONS: If you paid income tax to another country on

a tax return in a foreign language, you are required to sub-

If you wish to claim a resident credit on any other classes of

mit a translation or copy of the return, in English, with all

income subject to tax in another state or country or interest

amounts converted to U.S. dollars. You must also provide the

and dividend income subject to tax in another state, you must

conversion rate used. If the other country does not have a

see the instructions for and complete PA Schedule G-L. No

tax return system, please submit Federal Form 1116, Foreign

credit may be given on interest and dividend income from

Tax Credit, whether or not you file this form with your Form

another state unless classified as business income in

1040 return. Submit the information return that shows

Pennsylvania. To obtain Schedule G-L, use one of the Forms

your taxable income from the other country.

Ordering Services on page 3 of the PA-40 instruction booklet.

If claiming a resident credit from more than one state or coun-

Individual taxpayers who complete one or more PA

try, you must file a separate PA Schedule G-S for each state

Schedules G-S and/or PA Schedules G-L must list the

or country (unless otherwise provided for by the limitations

information from these schedules on one of Lines 1 through

per the instructions for Lines 2d and 2e, Column B).

20 of PA Schedule G-R. Resident credit will not be granted

Individual taxpayers must list the credits from each PA

unless PA Schedule G-R is completed.

Schedule G-S in Column E on one of Lines 1 through 20 of

PA Schedule G-R. Estates and trusts must total the allowable

Estates and trusts must total the allowable credit from Line

credit from Line 6 of all PA Schedules G-S and/or G-L and

6 of all PA Schedules G-S and/or G-L and enter the total on

enter the total on Line 13 of Form PA-41, the fiduciary

Line 13 of Form PA-41, the fiduciary income tax return.

income tax return.

GENERAL INSTRUCTIONS

You may not claim a resident credit for foreign income on which

If you can claim a resident credit as described above, your

no taxes were paid. The credit may only be claimed where the

credit is the lesser amount of:

income is taxed in, and tax is paid to, another country.

• The actual tax due to the other state or country (as may

You may not claim a resident credit on an individual return for

be adjusted), or

taxes paid by an estate or trust. The credit for taxes paid on

behalf of an estate or trust must be claimed on the fiduciary

• The tax calculated using the PA classified taxable income

return for the estate or trust. If all the income from the estate

that you earned, received or realized in the other state

or trust is distributed to an individual who is a beneficiary of

or country multiplied by the Pennsylvania tax rate of

the estate or trust, the individual may not claim the resident

3.07 percent (0.0307).

credit earned by the estate or trust.

If you file PA Schedule G-S, you are required to submit some

Pennsylvania income tax law does not allow a resident credit

or all of the following as appropriate:

for taxes paid to political subdivisions of other states. Ask

1. Copies of the income tax returns that you filed with the

your local taxing authority if you are eligible for a credit for

other states or countries.

the tax paid to a political subdivision outside Pennsylvania or

the difference between the tax you paid to another state and

2. A copy of each Form W-2 (if available) that shows the

the credit you claimed on your PA Schedule G-S.

compensation that the other states or countries taxed

(or a statement that shows how the compensation in the

SPECIFIC INSTRUCTIONS

other states or countries was determined).

Part I

3. Copies of the federal partnership K-1s showing amounts

Enter the name of the taxpayer or spouse who is claiming the

of foreign interest and dividend income subject to tax

credit. Taxpayers using the “Married Filing Jointly” status

and taxes paid to foreign countries along with a state-

may not claim the credit on a joint basis for any classes of

ment showing the interest and dividend income and

income except interest and dividend income. Separate PA

taxes paid on a country-by-country basis.

Schedules G-S and G-R must be prepared to report the

PAGE 2

1

1 2

2 3

3 4

4