2 of 4

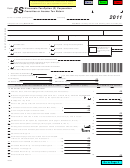

2011 Form 5S

Page

20 Interest, penalty, and late fee due (from Form 4U, line 17 or 26) .

.

00

If you annualized income on Form 4U, check (

)

the space after the arrow . . . . . . . . .

20

.

21 Tax due. If the total of lines 13 and 20 is larger than line 19, enter amount owed . . . . . . . . . . .

21

00

.

22 Overpayment. If line 19 is larger than the total of lines 13 and 20, enter amount overpaid . . .

22

00

.

00

23

23

Enter amount of line 22 you want credited to 2012 estimated tax

.

24 Subtract line 23 from line 22 . This is your refund . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

24

.

00

25 Enter total company gross receipts from all activities (see instructions) . . . . . . . . . . . . . . . . . .

25

.

00

26 Enter total company assets from federal Form 1120S, item F . . . . . . . . . . . . . . . . . . . . . . . . . .

26

27 If the tax-option corporation paid withholding tax on income distributable to nonresident

.

00

shareholders, enter total amount paid for all shareholders for the taxable year . . . . . . . . . . . .

27

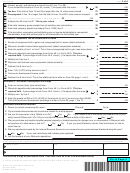

Schedule Q - Additional Tax on Certain Built-In Gains

.

00

1 Excess of recognized built-in gains over recognized built-in losses (attach schedule) . . . . . . . .

1

.

00

2 Wisconsin taxable income before apportionment (attach computation schedule) . . . . . . . . . . .

2

.

00

3 Enter the smaller of line 1 or line 2 . This is the net recognized built-in gain (see instructions) . .

3

4 Wisconsin apportionment percentage (from Form 4A-1 or Form 4A-2) . This is a

.

required field. If percentage is from Form 4A-2, check (

%

)

the space after the arrow

4

.

00

5 Multiply line 3 by line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5

.

00

6 Wisconsin net business loss carryforward (attach schedule) . . . . . . . . . . . . . . . . . . . . . . . . . . .

6

.

00

7 Subtract line 6 from line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

.

00

8 Enter 7 .9% (0 .079) of the amount on line 7 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

.

9 Community development finance credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

9

.

00

10 Subtract line 9 from line 8 . This is the additional tax to enter on Form 5S, page 1, line 9 . . . . . 10

Schedule S - Economic Development Surcharge

.

00

1 Enter net income (loss) (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

2 Wisconsin apportionment percentage (from Form 4A-1 or Form 4A-2) . This is a

.

required field. If percentage is from Form 4A-2, check (

%

)

the space after the arrow .

2

.

00

3 Multiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3

4 Enter the greater of $25 or 0 .2% (0 .002) of the amount on line 3, but not more than $9,800 .

.

00

This is the economic development surcharge to enter on Form 5S, page 1, line 10 . . . . . . . . .

4

Additional Information Required

1 Person to contact concerning this return:

Phone #:

Fax #:

2 City and state where books and records are located for audit purposes:

3 Are you the sole owner of any QSubs or LLCs?

Yes

No

If yes, attach a list of the names and federal EINs of your

solely owned QSubs and LLCs . Did you include the incomes of these entities in this return?

Yes

No

4 Did you purchase any taxable tangible personal property or taxable services for storage, use, or consumption in Wisconsin with-

out payment of a state sales or use tax?

Yes

No

If yes, you owe Wisconsin use tax . See instructions for how to

report use tax .

5 Did any adjustments made by the Internal Revenue Service to your income for prior years become finalized during this year?

Yes

No

If yes, see instructions and indicate years adjusted:

6 List the locations of your Wisconsin operations:

Under penalties of law, I declare that this return and all attachments are true, correct, and complete to the best of my knowledge and belief .

Signature of Officer

Title

Date

Preparer’s Signature

Preparer’s Federal Employer ID Number

Date

You must file a copy of your federal Form 1120S with Form 5S, even if no Wisconsin activity.

Go to Page 3

If you are not filing electronically, make your check payable to and mail your return to:

Wisconsin Department of Revenue

PO Box 8908

Madison WI 53708-8908

1

1 2

2 3

3 4

4