4 of 4

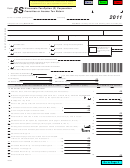

2011 Form 5S

Page

(a) Pro rata share items

(b) Federal amount

(c) Adjustment

(d) Amount under Wis . law

Deductions allocated and apportioned at corporate level to foreign source income:

.00

.00

.00

i Passive category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

j General category . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

k Other (attach statement) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other information:

l Total foreign taxes (check one):

.00

.00

.00

Paid

Accrued . . . .

.00

.00

.00

m Reduction in taxes for credit (attach statement) . . . . . . . . . .

n Other foreign tax information (attach statement) . . . . . . . . . .

.00

.00

.00

.00

.00

.00

15 a Post-1986 depreciation adjustment . . . . . . . . . . . . . . . . . . . .

b Adjusted gain or loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

.00

.00

c Depletion (other than oil and gas) . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

d Oil, gas, and geothermal properties – gross income . . . . . . .

.00

.00

.00

e Oil, gas, and geothermal properties – deductions . . . . . . . . .

.00

.00

.00

f Other AMT items (attach schedule) . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

16 a Tax-exempt interest income . . . . . . . . . . . . . . . . . . . . . . . . . .

b Other tax-exempt income . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

.00

.00

.00

c Nondeductible expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

d Property distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

e Repayment of loans from shareholders . . . . . . . . . . . . . . . . .

.00

.00

.00

17 a Investment income . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

b Investment expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

.00

c Dividend distributions paid from accumulated earnings and profits . . . . .

.00

.00

.00

.00

.00

.00

d Other items and amounts (attach schedule)

.00

18 a Related entity expense addback . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

b Related entity expense allowable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

19 Income/loss reconciliation (see instructions) . . . . . . . . . . . . .

.00

.00

20 Gross income (before deducting expenses) from all activities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

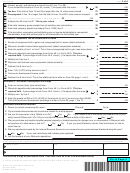

Schedule 5M – Analysis of Wisconsin Accumulated Adjustments Account and Other Adjustments Account

(a) Accumulated

(b) Other Adjustments

Adjustments Account

Account

.00

.00

1 Balance at beginning of taxable year . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

2 Ordinary income from Schedule 5K, line 1, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Other additions (including separately stated items which increase income) (attach schedule) . .

.00

.00

.00

(

)

4 Loss from Schedule 5K, line 1, column d . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5 Other reductions (including separately stated items which reduce income) (attach schedule) . . .

.00

.00

(

)

(

)

.00

.00

6 Combine lines 1 through 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

7 Distributions other than dividend distributions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

.00

.00

8 Subtract line 7 from line 6 . This is balance at end of taxable year . . . . . . . . . . . . . . . . . . . . .

Return to Page 1

1

1 2

2 3

3 4

4