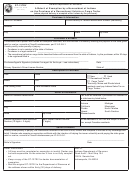

Instructions

One hundred percent of North Dakota estate taxes are distributed to cities and counties. The State

Treasurer uses the information from this affi davit, together with a statutory formula, to determine the

amount of tax distribution for each city and county involved.

The affi davit must be completed in its entirety, signed, and notarized.

An amended affi davit is necessary whenever there is a change in the gross value of an estate so that

adjustments can be made to the tax distribution.

Enter the decedent's name.

Line 1:

Enter the county of residence of the personal representative.

Line 2:

Enter the name of the personal representative.

Line 3:

Enter the city, county, and state which was the decedent's residence at the time of death.

Line 3b:

A decedent's residence at the time of death is the place considered by the decedent as a

permanent home and the place to which the decedent intended to return after an absence.

Enter the situs and gross value of the decedent's North Dakota property.

Line 3c:

The dollar value must be the total "gross" value.

The "gross" value of real property must be listed under the city or county where the property is

situated.

The "gross" value of personal property must be listed under the city in which the decedent

was a resident at the time of death; or, if the decedent resided in a rural area, it must be listed

under the county in which the decedent was a resident at the time of death. The place of the

decedent's residence determines the situs of all personal property.

Line 4:

Enter the total North Dakota estate tax as computed on the estate tax return or as assessed.

Line 5:

Enter the total interest due as computed on the estate tax return or as assessed.

Line 6:

Enter the total of line 4 plus line 5.

1

1 2

2