Form Dr 1002 - Colorado Sales/use Tax Rates Page 10

ADVERTISEMENT

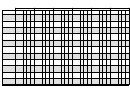

County in which

City

Service Fee

License

City

Address

Phone Number

City is Located

Sales Tax

Allowed

Fee

(see p. 7)

Rate

PO Box 1908

Rifle

970-625-2121

Garfield

3.5%

0

$12.00

Rifle CO 81650

$10.00

4101 S Federal

Sheridan

303-762-2200

Arapahoe

3.5%

0

$215.00

2

9

Sheridan, CO 80110

$65.00

10

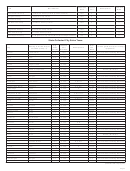

PO Box 1309

Silverthorne

970-262-7300

Summit

2%

2 1/3%

$75.00

6

Silverthorne, CO 80498

PO Box 5010

Snowmass Village

970-923-3796

Pitkin

3.5%

0

$85.00

Snowmass Village, CO 81615

PO Box 775088

Steamboat Springs

970-879-2060

Routt

4.75%

0

0

Steamboat Springs, CO 80477

PO Box 4000

Sterling

970-522-9700

Logan

3%

0

0

Sterling, CO 80751

PO Box 397

Telluride

970-728-3071

San Miguel

4.5%

1.35%

0

Telluride,CO 81435

9500 Civic Center Dr.

Thornton

303-538-7400

Adams

3.75%

3%

0

6

Thornton, CO 80229

PO Box 37

Timnath

970-224-3211

Larimer

3%

3 1/3%

W

Timnath, CO 80547

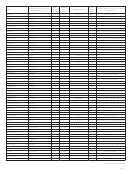

75 Frontage Rd.

Vail

970-479-2125

Eagle

4%

0

0

Vail, CO 81657

4800 W 92nd Ave.

Adams

Westminster

303-658-2065

3.85%

0

0

Westminster, CO 80031

Jefferson

7500 W 29th Ave.

Wheat Ridge

303-235-2820

Jefferson

3%

2%

$20.00

6

Wheat Ridge, CO 80033-8001

301 Walnut

Larimer

Windsor

970-686-7476

3.2%

2 1/3%

$10.00

6

Windsor, CO 80550

Weld

PO Box 3327

Winter Park

970-726-8081

Grand

5%

0

$60.00

Winter Park, CO 80482

PO Box 9045

3%

Woodland Park

719-687-9246

Teller

0

$50.00

Woodland Park, CO 80866-9045

1%

8

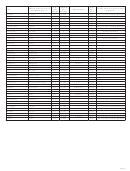

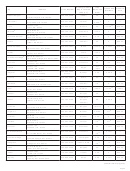

Footnotes for Home Rule Cities

Direct contact with these home rule cities is suggested to receive up-to-date information concerning their tax rates, exemptions, license

fees and procedures.

Corrections or changes since January 1, 2012 in bold.

2

Occupational Privilege Tax.

3

Sales tax on food & liquor for immediate consumption.

4

Food for home consumption.

5

Automobile rentals for less than 30 days.

6

Cap at a certain amount.

7

Sales tax rate is reduced if purchases are made from certain areas subject to either a Public Improvement Fee (PIF) and/or Retail

Sales Fee (RSF). All PIFs/RSFs imposed by home-rule cities are not listed in this publication. Contact the respective home-rule

city for more details.

8

Use tax

9

Business license for within city limits.

10

Business license for businesses outside city limits that do business within the city limits.

W

Contact the city directly.

Page 10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10