Form Dr 1002 - Colorado Sales/use Tax Rates Page 7

ADVERTISEMENT

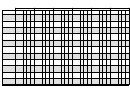

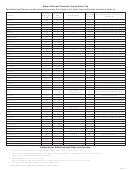

State-Collected Colorado County Sales Tax

Broomfield and Denver are self-collected counties. If a county is not listed, that county does not have a sales tax.

County

Service

Use Tax

Use Tax (paid to city or county)

County

Sales Tax

Fee

Exemptions

Rate

applies to:

Rate

Allowed

Adams

0.75%

0

A,B,C,D,E,F,G,H,K

None

Alamosa

2%

3 1/3%

None

Arapahoe

0.25%

0.5%

A,B,C,D,E,F,G,H,K,M

0.25%

Motor Vehicles, Building Materials

Archuleta

4%

3 1/3%

None

Bent

1%

0

1%

Motor Vehicles, Building Materials

Boulder

0.8%

0

A,B,C

0.8%

Motor Vehicles, Building Materials

Chaffee

2%

3%

E

None

Clear Creek

1%

0

None

Costilla

1%

0

None

Crowley

2%

3 1/3%

2%

Motor Vehicles, Building Materials

Custer

2%

3 1/3%

A,B,C,K

2%

Motor Vehicles, Building Materials

Delta

2%

3 1/3%

E,F

None

Douglas

1%

2 1/3%

6

A,C

1%

Motor Vehicles, Building Materials

Eagle

3 1/3%

A,B,C,K

None

1.5%

4

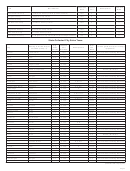

Elbert

1%

3 1/3%

A,B,C,D,E,G,H,K

1%

Motor Vehicles, Building Materials

El Paso

1%

0

A,B,C,K

1%

Motor Vehicles, Building Materials

Fremont

1.5%

3 1/3%

A,B,C,D,E,F,G,H,K

1.5%

Motor Vehicles, Building Materials

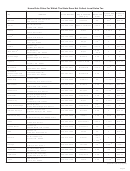

Garfield

1%

3 1/3%

A,B,C,K

None

Grand

1%

3 1/3%

None

Gunnison

1%

3 1/3%

None

Hinsdale

5%

3 1/3%

4%

Motor Vehicles, Building Materials

Huerfano

2%

3 1/3%

None

Jackson

4%

3 1/3%

None

Jefferson

0.5%

3 1/3%

None

Lake

4%

3 1/3%

None

La Plata

2%

3 1/3%

D,E, F,H,K,L,M

None

Larimer

0.6%

2.22%

A,B,C,D,E,F,G,H,K

0.6%

Motor Vehicles, Building Materials

Lincoln

2%

3 1/3%

F

2%

Motor Vehicles, Building Materials

Logan

1%

0

E,F,M

1%

Motor Vehicles, Building Materials

A,B,C,D,E,

Mesa

2%

3 1/3%

2%

Motor Vehicles, Building Materials

F,G,H,K,L,M

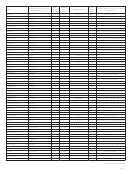

Mineral

5

3 1/3%

2%

Building Materials

2.6%

Moffat

2%

3 1/3%

None

Montrose

1%

3 1/3%

1%

Motor Vehicles, Building Materials

Otero

1%

3 1/3%

A,B,C,E,F,K

1%

Motor Vehicles, Building Materials

Ouray

2%

3 1/3%

None

Park

1%

3 1/3%

A,B,C,D,K

None

Phillips

1%

3 1/3%

E

1%

Motor Vehicles, Building Materials

Pitkin

0

0.5%

Motor Vehicles, Building Materials

3.6%

4

8

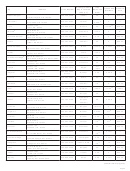

Pitkin (in Basalt)

2.6%

0

0.5%

Motor Vehicles, Building Materials

8

Prowers

1%

3 1/3%

1%

Motor Vehicles, Building Materials

Pueblo

1%

3 1/3%

A,B,C,K

1%

Motor Vehicles

Rio Blanco

3.6%

3 1/3%

C,D,E,M

3.6%

Motor Vehicles, Building Materials

Rio Grande

3 1/3%

None

2.6%

5

Routt

1%

3 1/3%

A,B,C,K

1%

Motor Vehicles, Building Materials

Saquache

1%

0

A,B,C,E,K

None

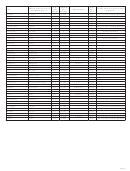

San Juan

4%

3 1/3%

None

San Miguel

1%

3%

A,B,C,K

1%

Building Materials

Sedgwick

2%

3 1/3%

2%

Motor Vehicles, Building Materials

Summit

4

3 1/3%

None

2.75%

Teller

1%

3 1/3%

A,B,C,K

1%

Motor Vehicles

Washington

1.5%

3 1/3%

A,B,D,E,F,G,H,K

1.5%

Motor Vehicles, Building Materials

Footnotes for State-Collected Cities and Counties

3

Contract city: For information regarding exemptions and use tax, contact the city directly.

4

Rate includes 0.5% Mass Transit System (MTS) in Eagle and Pitkin Counties and 0.75% in Summit County

5

Rate includes 0.6% Health Service District tax.

6

Cap of $200 per month on service fee.

7

Reduced sales tax rate of purchases from certain areas subject to a Public Improvement Fee.

8

Use tax rate is allocated as Mass Transit Tax (MTS) only.

Corrections or changes since January 1, 2012 in bold.

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10