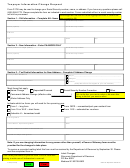

Form S-229 - Biotechnology Business Certification Request - Wisconsin Department Of Revenue Page 3

ADVERTISEMENT

identify targets for small molecule pharmaceutical develop-

Example: Company A files its federal income tax on a calen-

ment, or transform biological systems into useful processes

dar year basis. In 2012, Company A applies to be certified as

and products.

a Biotechnology Business for the period of January 1, 2012

to December 31, 2012 using the gross receipts test. On the

“Biotechnology” does not include merely selling biotech-

application for Current Year, Test 1, Company A enters its total

nology products produced by another person or performing

gross receipts from biotechnology in 2011 and its total gross

research or product development activities that use bio-

receipts from all activities in 2011.

technology for purposes other than for purposes expressly

indicated in the definition of “biotechnology.”

“Prior tax year” A business may apply for certification for a

prior tax year, but not for a tax year prior to January 1, 2012.

“Biotechnology Business” means a business, as certified

A prior tax year is one that has ended before the Department

by the Wisconsin Department of Revenue, that is primarily

of Revenue has received the application.

engaged in the application of biotechnologies that use

A business requesting certification for the prior tax year uses

a living organism or parts of an organism to produce or

its actual gross receipts, or expenses and deductions, from

modify products to improve plants or animals, develop

the prior tax year to qualify for certification.

microorganisms for specific uses, identify targets for small

molecule pharmaceutical development, or transform biological

A business whose tax year is a fiscal year will only be certified

systems into useful processes and products.

for the portion of its tax year occurring on and after January 1,

2012.

“Biotechnology business” does not include:

• Merely selling biotechnology products produced by

Example: Company B is a fiscal filer for federal income tax

purposes. Company B files an application to be certified as a

another person or performing research or product

development activities that use biotechnology for

Biotechnology Business for the tax period beginning March 1,

purposes other than for purposes expressly indicated in

2011 and ending February 29, 2012. On the application,

the definition of “biotechnology”

Company B checks Prior Year, Test 2, enters its expenses

and deductions from biotechnology for fiscal year ending

• Public or private institutions of higher education

February 29, 2012 and its total expenses and deductions

• Government agencies

for its fiscal year ending February 29, 2012. If approved, the

department will certify the business from January 1, 2012

“Biotechnology product” means a product produced using

through February 29, 2012.

the application of biotechnologies.

“Biotechnology service” means the provision of a service

“Gross receipts” are the amounts properly reported as

using the application of biotechnology.

indicated on the following forms:

• 2011 IRS Form 1120: U.S. Corporate Income Tax

“Grant funded biotechnology research and develop-

Return, Line 1e.

ment” means performing research and development using

biotechnology, as previously defined, that is funded by grants.

• 2011 IRS Form 1120-S: U.S. Income Tax Return for an

S-Corporations, Line 1e.

“Self-funded biotechnology research and development”

• 2011 IRS Form 1065: U.S. Return of Partnership

means performing research and development using biotech-

Income, Line 1e.

nology, as previously defined, that is funded by the taxpayer’s

own resources.

• 2011 IRS Form 1040, Schedule C: Profit or Loss From

Business, Line 3.

“Primarily” means more than 50%.

“Expenses and deductions” do not include:

C. Qualification Tests

• Net capital losses and net capital loss carryovers

A business may use this form to apply for certification for its

• Net losses from sales of assets

current tax year, a prior tax year, or both. A business is eligible

to be certified as a biotechnology business if it meets Test 1,

• Deductions for bad debts

Test 2, or Test 3, for the applicable year.

• Net operating loss deductions

“Current tax year” is the applicant’s tax year, for federal

• Charitable contributions

income tax purposes, that has not ended as of the time the

• Special deductions (Schedule C, Form 1120)

Wisconsin Department of Revenue receives the application.

In the case of a business not required to file its own federal

A business requesting certification for its current tax year will

income tax return, “gross receipts” or “expenses and

use its actual gross receipts, or expenses and deductions,

deductions” are determined in the same manner as a business

from the tax year immediately prior to the current tax year to

that is required to file its own federal income tax return.

qualify for certification and must believe, in good faith, that it

will continue to be primarily engaged in biotechnology during

Upon completion, mail this form and any accompanying

its current tax year. The business should include amounts

information to the attention of “Biotechnology Certification”

from activities both in and outside Wisconsin.

at the address provided on page 1.

A business whose tax year is a fiscal year will only be certified

for the portion of its tax year occurring on and after January 1,

2012.

- 3 -

S-229 (N. 3-12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3