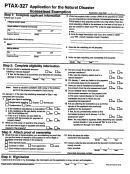

PTAX-327

Application for the Natural Disaster

Homestead Exemption

Application due date: ___/___/_______

Step 1: Complete applicant information

3

Write the property index number (PIN) of the property for which

you are requesting a natural disaster homestead exemption. Your

Please type or print.

1 ______________________________________________

PIN is listed on your property tax bill or you may obtain it from the

Property owner’s name

local assessing official at the address on the back of this form. If

___________________________________________________

you are unable to obtain your PIN, write the legal description on

Street address of property (homestead)

Line b.

___________________________________________________

City

State

ZIP

a

PIN

__________________________________________________

(______)_______________

_________________________

b

Write the legal description only if you are unable to obtain

Daytime phone

Email

your PIN. (Attach separate sheet if needed.)

_________________________________________________

Send notice to (if different than above)

_________________________________________________

2 ______________________________________________

Name

4

______________________________________________

Describe the rebuilding on the property.

Mailing address

–––––––––––––––––––––––––––––––––––––––––––––––––––

___________________________________________________

–––––––––––––––––––––––––––––––––––––––––––––––––––

City

State

ZIP

(______)_______________

_________________________

Daytime phone

Email

5

Write the date rebuilding was completed and occupied.

___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

Step 2: Complete eligibility information

9

6

Did you occupy the property as your

Did you rebuild a residential structure

principal residence?

Yes

No

following a natural disaster?

Yes

No

If Yes, list the date of its occurrence and describe the resulting

If No, was the property vacant due to a

damage or loss of property ___ ___/___ ___/___ ___ ___ ___

natural disaster?

Yes

No

Month

Day

Year

10 On January 1, were you liable for the payment

of real estate taxes on the property?

Yes

No

___________________________________________________

11

Have you sold or transferred ownership of

___________________________________________________

Note:

Attach a valuation complaint and a copy of the building

the property from the prior assessment year?

Yes

No

12

permit if the property is located in Cook County.

Do you already have a homestead

improvement exemption on this property due

On January 1 of the year the rebuilding described in Step 1 was

to the same natural disaster for the rebuilt

completed and occupied,

residential structure for which you are

7

Check your type of residence.

requesting this exemption?

Yes

No

Single-family dwelling

Duplex

Townhouse

13

Are you claiming the exemption as a surviving

Condominium

Other____________________________

spouse of the applicant who previously

qualified for the exemption?

Yes

No

a Is the residence operated as a cooperative?

Yes

No

b Is the residence a life care facility under the

If Yes, do you permanently reside on the

Life Care Facilities Act?

Yes

No

homestead property as of January 1 of the

c If Yes to a or b above, are you liable by

assessment year?

Yes

No

contract with the owner(s) for payment of

Note: You may attach a separate sheet describing your specific

property taxes?

Yes

No

factual situation if you answered “No” to any of the

8

Were you the owner of record for the property

questions 6 through 13 in Step 2.

or did you have a legal or equitable ownership

interest in the property?

Yes

No

Step 3: Attach proof of ownership

14

15

Check the type of documentation you are attaching as proof that

Write the date the written

you are the owner of record for the property or have a legal or

instrument was executed.

___ ___/___ ___/___ ___ ___ ___

Month

Day

Year

equitable ownership interest in the property.

16

If known, write the date recorded and the document number from the

Deed (specify type)________________________________

county records.

Contract for deed

Trust agreement

Lease

Date recorded:

___ ___/___ ___/___ ___ ___ ___

Other written instrument (please specify)

Month

Day

Year

________________________________________________

Recorded document number: ____________________________

Step 4: Sign below

I state that to the best of my knowledge, the information on this application is true, correct, and complete.

_______________________________________________________

___ ___/___ ___/___ ___ ___ ___

Property owner’s or authorized representative’s signature

Month

Day

Year

PTAX-327 Front (N-12/12)

1

1 2

2 3

3 4

4 5

5