General Information

What is the Natural Disaster Homestead

liable by contract with the owner(s) of record for the payment of

the apportioned property taxes on the property; and

Exemption (NDHE)?

an owner of record of a legal or equitable interest in the

The Natural Disaster Homestead Exemption is an exemption on

cooperative apartment building. Leasehold interest does not

homestead property for a rebuilt residential structure following a

qualify for this exemption.

natural disaster occurring in the taxable year 2012 or any taxable

year thereafter. The amount of the exemption is the reduction in

Is a surviving spouse eligible?

equalized assessed value (EAV) of the residence in the first taxable

The NDHE carries over to the benefit of a surviving spouse who

year for which the taxpayer applies for an exemption minus the

holds a legal or beneficial title to the homestead and permanently

equalized assessed value of the residence for the taxable year

resides on the property.

prior to the taxable year in which the natural disaster occurred. The

exemption continues at the same amount until the taxable year in

What is a natural disaster?

which the property is sold or transferred.

Note: Property is not eligible for the NDHE (35 ILCS 200/15-173)

Natural disaster means an occurrence of widespread or severe

and the Homestead Improvement Exemption

damage or loss of property resulting from any catastrophic cause

(35 ILCS 200/15-180) for the same natural disaster or catastrophic

including but not limited to fire, flood, earthquake, wind, storm,

event. The property may, however, remain eligible for an additional

or extended period of severe inclement weather. In the case of a

Homestead Improvement Exemption for any separate event occurring

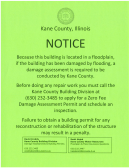

residential structure affected by flooding, the structure shall not be

after the property qualified for the NDHE.

eligible for an exemption unless it is located within a local jurisdiction

which is participating in the National Flood Insurance Program. A

Who is eligible?

proclamation of disaster by the President of the United States or

To be eligible for an exemption,

the Governor of the State of Illinois is not a prerequisite to the

you must own or have a legal or equitable interest in the property

classification of an occurrence as a natural disaster.

on which a single family residence is occupied as your principal

residence during the assessment year;

When should I file?

you must be liable for payment of the real estate taxes;

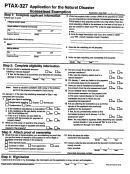

Your initial Form PTAX-327, Application for the Natural Disaster

the residential structure must be rebuilt within 2 years after the

Homestead Exemption, must be filed with the chief county

date of the natural disaster; and

assessment office no later than July 1 of the first taxable year after

the square footage of the rebuilt residential structure may not

the residential structure is rebuilt or the filing date set by your county.

be more than 110 percent of the square footage of the original

The county’s due date to file this form is printed on the front of this

residential structure as it existed immediately prior to the natural

application. You must continue to file Form PTAX-327 every year

disaster.

and meet the qualifications to continue to receive the NDHE. The

chief county assessment office may require you to submit additional

If you are a resident of a cooperative apartment building or life care

documentation as proof for this exemption.

facility as defined under Section 2 of the Life Care Facilities Act,

you are still eligible to receive the NDHE provided you occupy the

property as your primary residence and you are

What if I need additional assistance?

Mail your completed Form PTAX-327 to:

If you need additional assistance, please contact the local assessing

Kane County Supervisor of Assessments

_____________________________________________________

official.

Local assessing official

Kane

_____________________________________________________

630 208-3818

Phone: (_____)__________________________

County

719 South Batavia Avenue, Building C

_____________________________________________________

Mailing address

Geneva

60134

___________________________________________IL________

City

ZIP

Official use. Do not write in this space.

Assessment Information of Residence

___ ___/___ ___/___ ___ ___ ___

Date received by CCAO:

Month

Day

Year

Square footage: __________________

__________________

___ ___/___ ___/___ ___ ___ ___

CCAO action date:

Original residence

Rebuilt residence

Month

Day

Year

Note: SF of original residence x 110% = maximum SF to qualify for NDHE.

First year of application:

Approved

Denied

___ ___ ___ ___

$___________________________

Year

EAV of rebuilt structure (no land value)

Reason for denial:

_____________________________________

_______________________________________________________

Year prior to natural disaster:

_______________________________________________________

___ ___ ___ ___

$___________________________

EAV of original structure (no land value)

Year

_______________________________________________________

_______________________________________________________

Proposed increase in EAV attributable

_______________________________________________________

$___________________________

solely to rebuilt structure:

_______________________________________________________

Note: EAV of rebuilt structure - EAV of original structure = NDHE amount.

_______________________________________________________

PTAX-327 Back (N-12/12)

1

1 2

2 3

3 4

4 5

5