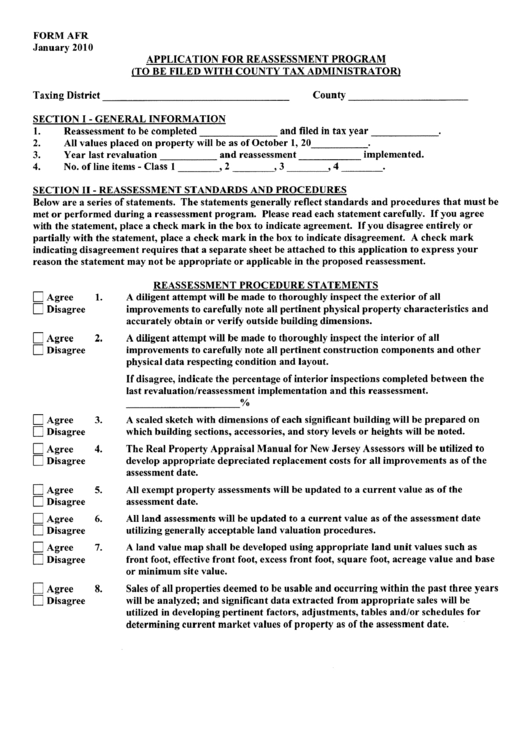

FORM AFR

January 2010

APPLICATION FOR REASSESSMENT PROGRAM

(TO BE FILED WITH COUNTY TAX ADMINISTRATOR)

Taxing District

____________________________________

County

_______________________

SECTION I

-

GENERAL INFORMATION

1.

Reassessment to be completed

________________

and filed in tax year

______________

2.

All values placed on property will be as of October 1, 20

3.

Year last revaluation

____________

and reassessment

_____________

implemented.

4.

No. of line items

-

Class 1

_________,

2

_________,

3

_________,

4

_________

SECTION II- REASSESSMENT STANDARDS AND PROCEDURES

Below are a series of statements. The statements generally reflect standards and procedures that must be

met or performed during a reassessment program. Please read each statement carefully. If you agree

with the statement, place a check mark in the box to indicate agreement. If you disagree entirely or

partially with the statement, place a check mark in the box to indicate disagreement. A check mark

indicating disagreement requires that a separate sheet be attached to this application to express your

reason the statement may not be appropriate or applicable in the proposed reassessment.

REASSESSMENT PROCEDURE STATEMENTS

LI

Agree

1.

A diligent attempt will be made to thoroughly inspect the exterior of all

LI

Disagree

improvements to carefully note all pertinent physical property characteristics and

accurately obtain or verify outside building dimensions.

LI

Agree

2.

A diligent attempt will be made to thoroughly inspect the interior of all

LI

Disagree

improvements to carefully note all pertinent construction components and other

physical data respecting condition and layout.

If disagree, indicate the percentage of interior inspections completed between the

last revaluation/reassessment implementation and this reassessment.

_____________%

LI

Agree

3.

A scaled sketch with dimensions of each significant building will be prepared on

LI

Disagree

which building sections, accessories, and story levels or heights will be noted.

LI

Agree

4.

The Real Property Appraisal Manual for New Jersey Assessors will be utilized to

LI

Disagree

develop appropriate depreciated replacement costs for all improvements as of the

assessment date.

LI

Agree

5.

All exempt property assessments will be updated to a current value as of the

LI

Disagree

assessment date.

LI

Agree

6.

All land assessments will be updated to a current value as of the assessment date

LI

Disagree

utilizing generally acceptable land valuation procedures.

LI

Agree

7.

A land value map shall be developed using appropriate land unit values such as

LI

Disagree

front foot, effective front foot, excess front foot, square foot, acreage value and base

or minimum site value.

LI

Agree

8.

Sales of all properties deemed to be usable and occurring within the past three years

LI

Disagree

will be analyzed; and significant data extracted from appropriate sales will be

utilized in developing pertinent factors, adjustments, tables and/or schedules for

determining current market values of property as of the assessment date.

1

1 2

2