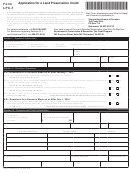

PA SCHEDULE OC

(11-12) (FI)

2012

PA DEPARTMENT OF REVENUE

IMPORTANT: If you are claiming credits from a pass-through

8. PA Neighborhood Assistance Program Tax Credit

entity of which you are an owner, verify with the entity that it

Enter the amount from the PA Department of Community

contacted the Bureau of Corporation Taxes, Accounting Division,

and Economic Development certification you received.

to pass through the credit. Listing the amount of credit on the

9. PA Strategic Development Area Job Creation Tax

owner’s individual RK-1 or NRK-1 is not sufficient to pass

through the credit. Contact information for the Bureau of

Credit

Corporation Taxes is on the credit award letter.

Enter the amount from the PA Department of Community

and Economic Development certification you received.

1. PA Employment Incentive Payments Credit

If you employ welfare recipients, you may be eligible for

10. PA Educational Improvement Tax Credit

this credit. Submit a completed PA Schedule W with all

Enter the amount from the PA Department of Community

required supporting documents.

and Economic Development certification you received.

2. PA Job Creation Tax Credit

11. PA Opportunity Scholarship Tax Credit

Enter the amount of credit the PA Department of

Enter the amount from the PA Department of Community

Community and Economic Development approved on the

and Economic Development certification you received.

certification sent to you.

12. PA Alternative Energy Production Tax Credit

3. PA Research and Development Tax Credit

Enter the amount from the PA Department of Revenue

Enter the amount of credit from the Department of

certification that you received.

Revenue certification you received.

4. PA Film Production Tax Credit

13. Keystone Special Development Zone Tax Credit

Enter the amount from the PA Department of Revenue or

Enter the amount from the PA Department of Community

PA Department of Community and Economic Development

and Economic Development certification you received.

certification you received.

14. Other restricted credits not listed above

5. PA Organ and Bone Marrow Donor Tax Credit

Restricted credits are tax credits which are included in PA

Enter the amount from the PA Department of Revenue

certification you received.

legislation and must be applied for with specific PA

agencies. If a restricted credit is not shown above, enter

6. PA Keystone Innovation Zone Tax Credit

the type of credit in the space provided and the amount of

Enter the amount from the PA Department of Community

credit received from the awarding PA government agency.

and Economic Development certification you received.

15. Total PA Other Credits

7. PA Resource Enhancement and Protection Tax Credit

Add Lines 1 through 14. Enter the total here and on Line 23

Enter the amount from the PA Department of Revenue

certification you received.

of Form PA-40 or Line 14 of Form PA-41.

RETURN TO FORM

PAGE 2

1

1 2

2