2014 TAX CHART

If Missouri taxable income from Form MO-1041, Line 13, is less than $9,000, use the chart to figure tax;

if more than $9,000, use worksheet below or use the online tax calculator at

If the Missouri taxable income is:

The tax is:

$0 to $99 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $0

At least $100 but not over $1,000 . . . . . . . . . . . . . . . . . . . 1½% of the Missouri taxable income

Over $1,000 but not over $2,000 . . . . . . . . . . . . . . . . . . . $15 plus 2% of excess over $1,000

Over $2,000 but not over $3,000 . . . . . . . . . . . . . . . . . . . $35 plus 2½% of excess over $2,000

Over $3,000 but not over $4,000 . . . . . . . . . . . . . . . . . . . $60 plus 3% of excess over $3,000

Over $4,000 but not over $5,000 . . . . . . . . . . . . . . . . . . . $90 plus 3½% of excess over $4,000

Over $5,000 but not over $6,000 . . . . . . . . . . . . . . . . . . . $125 plus 4% of excess over $5,000

Over $6,000 but not over $7,000 . . . . . . . . . . . . . . . . . . . $165 plus 4½% of excess over $6,000

Over $7,000 but not over $8,000 . . . . . . . . . . . . . . . . . . . $210 plus 5% of excess over $7,000

Over $8,000 but not over $9,000 . . . . . . . . . . . . . . . . . . . $260 plus 5½% of excess over $8,000

Over $9,000 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $315 plus 6% of excess over $9,000

Yourself

Spouse

Example

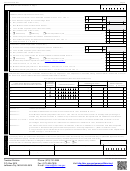

If more than $9,000,

$ _______________

$ _______________

tax is $315 PLUS 6% of

Missouri taxable income (Line 24) .......

$ 12,000

excess over $9,000.

Subtract $9,000 ................................

– $

9,000

– $

9,000

– $ 9,000

Round to nearest whole

Difference .........................................

= $ _______________

= $ _______________

= $ 3,000

dollar and enter on Form

Multiply by 6%...................................

x

6%

x

6%

x

6%

MO-1041, Line 14.

= $ _______________

= $ _______________

Tax on income over $9,000

= $

180

Add $315 (tax on first $9,000) ..........

+ $

315

+ $

315

+ $

315

TOTAL MISSOURI TAX ...................

= $ _______________

= $ _______________

= $

495

A separate tax must be computed for you and your spouse.

Form MO-1041 Instructions (Revised 12-2014)

10

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10