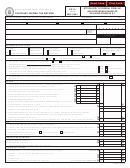

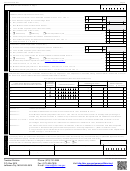

Form MO-1041

If you receive an extension of time to file your federal fiducia-

ry tax return, you will automatically be granted an extension

of time to file your Missouri fiduciary tax return, provided you

Filing Information

do not expect to owe any additional Missouri fiduciary tax.

Attach a copy of your federal extension (Federal Form 7004)

with your Missouri fiduciary tax return when you file.

If you expect to owe Missouri fiduciary tax, file

Form MO-60

General Information

with your payment by the original due date of the return.

This information is for guidance only and does not state the

Remember: An extension of time to file does not extend

complete law.

the time to pay. A 5 percent addition to tax will apply if

Who Must File Form MO-1041

the tax is not paid by the original return’s due date.

A return must be filed by the following:

Report of Changes in Federal Taxable Income

1. Every resident estate or trust that is required to file a

Federal Form 1041.

If the taxpayer’s federal taxable income for any taxable year

2. Every nonresident estate or trust that has any taxable

is changed, the taxpayer must report the change to Missouri

income from sources within Missouri or gross income of

by filing an amended Missouri return within 90 days after the

$600 or more from sources within Missouri.

final determination of such change. When filing an amended

federal return you must file an amended Missouri return

Definition of Resident Estate or Trust

within 90 days of the federal change. The taxpayer will be

A Resident Estate or Trust is: 1) The estate of a decedent

subject to interest and additions to tax charges if additional

who at his or her death was domiciled in this state; or 2) A

tax is owed to Missouri.

trust that was created by a will of a decedent who at his or

Amended Return

her death was domiciled in this state, and has at least one

income beneficiary who, on the last day of the taxable year,

To file an amended Missouri return, use Form MO-1041

was a resident of this state; or 3) A trust that was created by,

and check the box at the top right of the form. Complete

or consisting of property of, a person domiciled in this state

the entire return using the corrected figures. Attach a state-

on the date the trust or portion of the trust became irrevo-

ment giving the reason for the amended return and enclose

cable, and has at least one income beneficiary who, on the

a copy of the federal change(s) and the federal amended

last day of the taxable year, was a resident of this state.

return.

Missouri Tax Treatment of Qualified Funeral Trusts

When and Where to File

The calculation of the Missouri tax liability for a qualified funeral

Calendar year taxpayers must file no later than April 15,

trust is the same as the federal computation. If the composite

2015.

Late filing will subject taxpayers to charges for

return box on Federal Form 1041 QFT is marked, the tax of

interest and additions to tax. Fiscal year filers must file no

each funeral trust is determined on a separate basis,

later than the 15th day of the fourth month following the

disclosed on an attached schedule and then combined on

close of their taxable year. When the due date falls on a

the Missouri return resulting in a composite filing.

The

Saturday, Sunday, or legal holiday, the return and payment

schedule used to calculate the Missouri income tax must

will be considered timely if filed on the next business day.

be attached to the return when it is filed.

Please mail the return to: Department of Revenue, P.O. Box

3815, Jefferson City, MO 65105-3815.

Electing Small Business Trust (ESBT)

The income earned by an ESBT must be reported on the

Rounding on Missouri Returns

Missouri return and tax paid accordingly. ESBT income is

Rounding is required on your tax return. Zeros have been

reported on the return as if it was regular income; however,

placed in the cents columns on your return. For 1 cent

the deductions are limited to only offset ESBT income

through 49 cents, round down to the previous whole dollar

and cannot be used to reduce other income. A separate

amount. For 50 cents through 99 cents, round up to the next

schedule must be attached to the return to show the ESBT

whole dollar amount.

income and deductions. The Missouri taxable income, Form

Example: Round $32.49 down to $32.00 Round $32.50 up to

MO-1041, Line 13, must include the ESBT income, including

$33.00.

subtractions and additions. The ESBT income is taxed at

the same rate as all other income for a trust.

Estimated Tax Payments

The state of Missouri currently does not require the payment

To Obtain Forms

of estimated tax by an estate or trust.

To use the Department’s form selector or to obtain specific

tax forms visit our web site at

Extension of Time to File

You are not required to file an extension if you do not

expect to owe additional Missouri fiduciary tax or if you

anticipate receiving a refund. If you wish to file a Missouri

extension, and do not expect to owe Missouri fiduciary tax,

you may file an extension by filing Form MO-60, Application

for Extension of Time to File. An automatic extension of time

to file will be granted until October 15, 2015.

4

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10