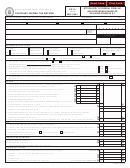

2014 Form MO-1041

Page 2

Name of Estate or Trust As Shown on Page 1

Federal Identification Number

Enter Missouri modifications which are related to items of income, gain, loss, and deductions that are determinants of federal distributable net income.

Additions (attach explanation of each item)

1. State and local income taxes deducted on Federal Form 1041, Line 11 .............................. 1

00

2. Less: Kansas City and St. Louis earnings taxes ................................................................... 2

00

3. Net (subtract Line 2 from Line 1) ..................................................................................................................................

3

00

4. Non-Missouri state and local bond interest .......................................................................... 4

00

5. Less: related expenses (omit if less than $500) .................................................................. 5

00

6. Net (subtract Line 5 from Line 4) ..................................................................................................................................

6

00

r

r

r

7.

Partnership

Fiduciary

Other adjustments (list ____________________________________) ......

7

00

8. Food Pantry contributions included on Federal Schedule A .........................................................................................

8

00

9. Nonresident Property Tax deducted on Federal Form 1041, Line 11 ...........................................................................

9

00

10. Total of Lines 3, 6, 7, 8, and 9 ...................................................................................................................................... 10

00

Subtractions (attach explanation of each item)

11. Interest from exempt federal obligations (attach a detailed list) .......................................... 11

00

12. Less: related expenses (omit if less than $500) .................................................................. 12

00

13. Net (subtract Line 12 from Line 11) .............................................................................................................................. 13

00

14. Amount of any state income tax refund included in federal taxable income ................................................................. 14

00

r

r

r

15.

Partnership

Fiduciary

Other adjustments (list ____________________________________) ...... 15

00

16. Missouri depreciation adjustment (See

Section 143.121,

RSMo.) ............................................................................. 16

00

17. Total of Lines 13, 14, 15, and 16 .................................................................................................................................. 17

00

18. Missouri fiduciary adjustment — Net Addition — subtract Line 17 from Line 10 .......................................................... 18

00

19. Missouri fiduciary adjustment — Net Subtraction — subtract Line 10 from Line 17 ..................................................... 19

00

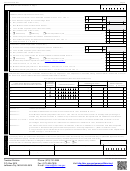

Complete Part 2 only if Part 1 indicates a Missouri fiduciary adjustment. The adjustment is allocated among all beneficiaries and estate or trust in

the same ratio as their relative shares of federal distributable net income.

Complete List of Beneficiaries (Resident And Nonresident)

6. Shares Of Missouri

Shares Of Federal

2. Select Box

1. Name Of Each Beneficiary. All Beneficiaries

Distributable Net Income

Fiduciary Adjustment

if Beneficiary is

3. Social Security Number

Must Be Listed. Use Attachment If More Than Four.

r

r

Addition

Subtraction

Nonresident

5. Amount

4. Percent

a)

r

%

00

00

r

b)

%

00

00

r

c)

%

00

00

r

d)

%

00

00

Charitable Beneficiaries

%

00

00

Estate or Trust

%

00

00

Totals

100%

00

00

Column 4 —

Indicate percentages.

Column 5 —

Total federal distributable net income from Federal Form 1041, Schedule B, Line 7.

Column 6 —

Enter Missouri fiduciary adjustment from Part 1, Line 18 or 19, as the total of Column 6. Multiply each percentage in

Column 4 by the total in Column 6. Indicate at top of Column 6 whether the adjustments are additions or subtractions.

Columns 4, 5, and 6 — Attach a detailed explanation of the allocation method used if there is no federal distributable net income or if the

percentages do not agree with the relative shares indicated on Federal Form 1041, Schedules B and K-1.

Column 6 —

The amount after each name is reported as a modification, either as an addition to or subtraction from federal adjusted

gross income. Each beneficiary should add the explanation: “Fiduciary Adjustment — (Name of estate or trust)”.

A copy of this part (or its information) must be provided to each beneficiary. The estate or trust’s share of the adjustment is

entered on Page 1, Line 8 or Line 10.

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any returned check may be presented again electronically.

Under penalties of perjury, I declare that the above information and any attached supplement is true, complete, and correct.

I authorize the Director of Revenue or delegate to discuss my return and attachments with the preparer or any member

Preparer’s Phone Number

of his or her firm, or if internally prepared, any member of the internal staff.

r

Yes

r

No

(__ __ __) __ __ __-__ __ __ __

Signature of Fiduciary or Officer Representing Fiduciary

Signature of Preparer Other Than Fiduciary

FEIN or PTIN

Date (MM/DD/YYYY)

Telephone No.

Address

Date (MM/DD/YYYY)

__ __ /__ __ /__ __ __ __ (__ __ __) __ __ __-__ __ __ __

__ __ /__ __ /__ __ __ __

Form MO-1041 (Revised 12-2014)

Phone: (573) 751-3505

Taxation Division

Fax: (573) 526-7939

P.O. Box 3815

Visit

E-mail:

income@dor.mo.gov

Jefferson City, MO 65105-3815

for additional information.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10