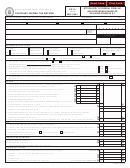

Part 2: Modifications to Missouri Source Items

Column

Part 1, Missouri Source Column

Form MO-NRF, Part 2, computes the Missouri modifications

to the Missouri source income.

1

Line 2

2

Line 4S

Line 1:

Enter the sum of all positive adjustments (addi-

tions) to the Missouri source income.

List the qualifying

3

Line 4L

modifications and provide a brief description in the space

4

Remaining Lines (3, 5–8)

provided.

For additional information regarding qualifying

addition modifications, refer to the instructions for Form

Columns 5 and 6 — Depreciation and Other:

MO-1041, Part 1, Lines 1 through 9 (Missouri Fiduciary

Indicate the amount reported on the Federal Schedule K-1

Adjustment - see page 4 of the instructions).

on the top line of each row (Schedule K-1). Indicate the

Line 2:

Enter the sum of all negative adjustments (subtrac-

amount of Missouri source income on the bottom of each

tions) to the Missouri source income.

List the qualifying

row (MO).

modifications and provide a brief description in the space

provided.

For additional information regarding qualifying

Federal Privacy Notice

subtractions modifications, refer to the instructions for Form

MO-1041, Part 1, Lines 11 through 16 (Missouri Fiduciary

The Federal Privacy Act requires the Missouri Department of Revenue (Depart-

Adjustment - see pages 4 and 5 of the instructions).

ment) to inform taxpayers of the Department’s legal authority for requesting

identifying information, including social security numbers, and to explain why the

Line 3:

Enter this amount on the “Totals” Line on Part 4

information is needed and how the information will be used.

(Allocation of Missouri fiduciary adjustments), Column 5.

Chapter 143 of the Missouri Revised Statutes

authorizes the Department to

request information necessary to carry out the tax laws of the state of Missouri.

Part 3: Missouri Source Federal Income Tax

Federal law 42 U.S.C. Section 405 (c)(2)(C) authorizes the states to require

taxpayers to provide social security numbers.

The federal tax reported on Line 4 (not to exceed $5,000),

The Department uses your social security number to identify you and process

should be adjusted based on the percentage of income

your tax returns and other documents, to determine and collect the correct

attributable to Missouri. This percentage reported on Line

amount of tax, to ensure you are complying with the tax laws, and to

5 is calculated by dividing the Missouri source distributable

exchange tax information with the Internal Revenue Service, other states,

net income (Form MO-NRF, Part 1, Line 24) by the federal

(Chapters 32 and 143,

RSMo).

and the Multistate Tax Commission

In addition, statutorily provided non-tax uses are: (1) to provide information

distributable net income (Form MO-NRF, Part 1, Line 23).

to the Department of Higher Education with respect to applicants for financial

The percentage cannot exceed 100 percent or be less than

assistance under

Chapter 173, RSMo

and (2) to offset refunds

0 percent. The amount from Line 4 is multiplied by this

against amounts due to a state agency by a person or entity (Chapter

percentage on Line 5 and is entered on Line 6, and on Part

143, RSMo). Information furnished to other agencies or persons shall be

5 (Missouri Taxable Income), Line 6 of this form.

used solely for the purpose of administering tax laws or the specific laws

administered by the person having the statutory right to obtain it [as

Part 4: Shares of Missouri Source Fiduciary

indicated above]. In addition, information may be disclosed to the public

regarding the name of a tax credit recipient and the amount issued to such

Adjustment

(Chapter 135,

RSMo). (For the Department’s authority to prescribe

recipient

Information to help complete this section is located on

Chapters 135,

forms and to require furnishing of social security numbers, see

Form MO-NRF, Part 4.

143, and 144,

RSMo.)

You are required to provide your social security number on your tax return.

Part 5: Missouri Taxable Income

Failure to provide your social security number or providing a false social security

number may result in criminal action against you.

Complete Lines 1 through 8. Included on Line 3, should

be the addition or subtraction of any capital gains or losses

used to determine distributable net income (see Part 1, Line

22 of Form MO-NRF). Enter the total from Line 9 on Form

MO-1041, Line 13.

Other Important Phone Numbers

Part 6: Shares of Missouri Source Income and

General Inquiry Line

(573) 751-3505

Deductions—Nonresident Beneficiary

Information to help complete this section is located on Form

Download forms from our website:

MO-NRF, Part 6.

Suggestions for Tax System Improvements e-mail:

Note:

taxsuggest@dor.mo.gov

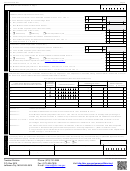

Columns 1 through 4 —

Indicate the amount reported

on the Federal Schedule K-1 on the top line of each row

(Schedule K-1).

Indicate the amount of Missouri source

income on the bottom of each row (MO). The figure for each

column can be located from Form MO-NRF Part 1, Missouri

source column. See the following table for line numbers:

Form MO-1041 Instructions (Revised 12-2014)

9

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10