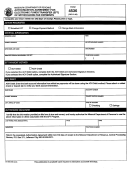

Minnesota Withholding Tax Tables - Minnesota Department Of Revenue - 2015 Page 2

ADVERTISEMENT

Single employees paid every day

If the employee’s

Number of withholding allowances

wages are

0

1

2

3

4

5

6

7

8

9

10

at

but less

least

than

The amount to withhold (in whole dollars)

or more

0

24

0

0

0

0

0

0

0

0

0

0

0

24

28

1

0

0

0

0

0

0

0

0

0

0

28

32

1

1

0

0

0

0

0

0

0

0

0

32

36

1

1

0

0

0

0

0

0

0

0

0

36

40

2

1

1

0

0

0

0

0

0

0

0

40

44

2

1

1

0

0

0

0

0

0

0

0

44

48

2

2

1

0

0

0

0

0

0

0

0

48

52

2

2

1

1

0

0

0

0

0

0

0

52

56

3

2

1

1

0

0

0

0

0

0

0

56

60

3

2

2

1

0

0

0

0

0

0

0

60

64

3

2

2

1

1

0

0

0

0

0

0

64

68

3

3

2

1

1

0

0

0

0

0

0

68

72

3

3

2

2

1

0

0

0

0

0

0

72

76

4

3

2

2

1

1

0

0

0

0

0

76

80

4

3

3

2

1

1

0

0

0

0

0

80

84

4

3

3

2

2

1

0

0

0

0

0

84

88

4

4

3

2

2

1

1

0

0

0

0

88

92

5

4

3

3

2

2

1

0

0

0

0

92

96

5

4

3

3

2

2

1

1

0

0

0

96 100

5

4

4

3

3

2

1

1

0

0

0

100 104

6

5

4

3

3

2

2

1

0

0

0

104 108

6

5

4

4

3

2

2

1

1

0

0

108 112

6

5

5

4

3

3

2

1

1

0

0

112 116

6

6

5

4

3

3

2

2

1

0

0

116 120

7

6

5

4

4

3

2

2

1

1

0

120 124

7

6

5

5

4

3

3

2

1

1

0

124 128

7

6

6

5

4

3

3

2

2

1

0

128 132

8

7

6

5

4

4

3

2

2

1

1

132 136

8

7

6

5

5

4

3

3

2

1

1

136 140

8

7

7

6

5

4

3

3

2

2

1

140 144

8

8

7

6

5

4

4

3

2

2

1

144 148

9

8

7

6

6

5

4

3

3

2

2

148 152

9

8

7

7

6

5

4

4

3

2

2

152 156

9

8

8

7

6

5

5

4

3

3

2

156 160

10

9

8

7

6

6

5

4

3

3

2

7.05 PERCENT (.0705) OF THE EXCESS OVER $160 PLUS (round total to the nearest whole dollar)

160 235

10

9

8

7

7

6

5

4

3

3

2

7.85 PERCENT (.0785) OF THE EXCESS OVER $235 PLUS (round total to the nearest whole dollar)

235 437

15

14

13

13

12

11

10

9

9

8

7

9.85 PERCENT (.0985) OF THE EXCESS OVER $437 PLUS (round total to the nearest whole dollar)

437 and over

31

30

29

28

27

26

26

25

24

23

22

16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20