Minnesota Income Tax Withholding - Minnesota Department Of Revenue - 2017 Page 10

ADVERTISEMENT

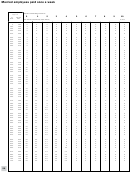

Worksheet A

(for quarterly filers only)

TABLE A — Payroll Information

Quarterly return for period ending

Minnesota tax ID

Payroll Date

Tax Withheld

1 Wages paid to employees during the quarter

(see “All Filers” on page 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total number of employees during the quarter . . . . . . . . . . . . . 2

3 Total Minnesota income tax withheld for the quarter

(from Table A). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Total deposits and credit (sum of Table B and any

credit carried forward from prior quarter) . . . . . . . . . . . . . . . . . . 4

5 Total amount due. Subtract line 4 from line 3.

TOTAL WITHHELD (enter on line 3)

(If result is less than zero, go to line 6) . . . . . . . . . . . . . . . . . . . . 5

To pay electronically, enter the following banking information:

Routing Number:

Account Number:

TABLE B — Deposit Information

6 If line 5 is less than zero, the system will carry the amount forward to the next quarter

Date

Tax Deposited

unless you choose to have some or all of the amount refunded.

Indicate your choice below:

6a Credit to carry forward:

(include on line 4 of next quarter’s Worksheet A)

6b Credit to be refunded:

.

To request direct deposit, enter the following banking information:

Routing Number:

Account Number:

TOTAL DEPOSITS (include on line 4)

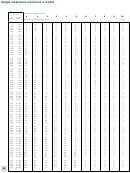

Worksheet B

(for annual filers only)

TABLE A — Payroll Information

Annual return for

Minnesota tax ID

(year)

Payroll Date

Tax Withheld

1 Wages paid to employees during the year

(from Forms W-2) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

2 Total number of employees during the year . . . . . . . . . . . . . . . . . 2

3 Total Minnesota income tax withheld for the year reported

on Forms W-2 and 1099 (from Table A) . . . . . . . . . . . . . . . . . . . . . 3

4 Total deposits and credit (sum of Table B and any

credits carried forward from prior year) . . . . . . . . . . . . . . . . . . . . 4

5 Total amount due. Subtract line 4 from line 3.

TOTAL WITHHELD (enter on line 3)

(If result is less than zero, go to line 6) . . . . . . . . . . . . . . . . . . . . . 5

To pay electronically, enter the following banking information:

Routing Number:

Account Number:

TABLE B — Deposit Information

6 If line 5 is less than zero, the system will carry the amount forward to the next year

Date

Tax Deposited

unless you choose to have some or all of the amount to be refunded.

Indicate your choice below:

6a Credit to carry forward:

(include on line 4 of next year’s Worksheet B)

6b Credit to be refunded:

.

To request direct deposit, enter the following banking information:

Routing Number:

Account Number:

TOTAL DEPOSITS (include on line 4)

You must file your return electronically. See instructions on page 11.

10

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31 32

32 33

33 34

34