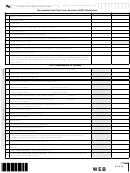

IT-540B WEB

(Page 2 of 4)

Enter your Social Security Number.

If you are not required to file a federal

Mark this box and enter zero “0” on Line 17.

return, indicate wages here.

FEDERAL ADjUSTED GROSS INCOME – Enter the amount of your Federal Adjusted Gross Income from

7

7

the NPR worksheet, Federal column, Line 12.

LOUISIANA ADjUSTED GROSS INCOME – Enter the amount of your Louisiana Adjusted Gross Income

8

8

from the NPR worksheet, Louisiana column, Line 33.

RATIO OF LOUISIANA ADjUSTED GROSS INCOME TO FEDERAL ADjUSTED GROSS INCOME –

9

9

Divide Line 8 by Line 7. Carry out to two decimal places in the percentage. DO NOT ROUND UP. The

percentage cannot exceed 100%.

If you did not itemize your deductions on your federal return, leave Lines 10A, 10B, and 10C

blank and go to Line 10d.

10A

FEDERAL ITEMIZED DEDUCTIONS

10A

10B

FEDERAL STANDARD DEDUCTION

10B

10C

ExCESS FEDERAL ITEMIZED DEDUCTIONS – Subtract Line 10B from Line 10A.

10C

FEDERAL INCOME TAx – If your federal income tax has been decreased by a federal disaster

10D

10d

credit allowed by IRS, mark the box. See instructions for Schedule H-NR.

10E

TOTAL DEDUCTIONS – Add Lines 10C and 10D.

10E

10F

ALLOWABLE DEDUCTIONS – Multiply Line 10E by the percentage on Line 9. Round to the nearest dollar.

10F

11

LOUISIANA NET INCOME – Subtract Line 10F from Line 8. If less than zero, enter “0.”

11

YOUR LOUISIANA INCOME TAx – See the Tax Computation Worksheet to calculate the amount of your

12

12

Louisiana income tax.

FEDERAL CHILD CARE CREDIT – Enter the amount from your Federal Form 1040A, Line 31, or Federal Form

13A

13A

1040, Line 49. This amount will be used to compute your 2014 Louisiana Nonrefundable Child Care Credit.

2014 LOUISIANA NONREFUNDABLE CHILD CARE CREDIT – your Federal Adjusted Gross Income

13B

13B

must be GrEATEr THAN $25,000 to claim a credit on this line. See Nonrefundable Child Care Credit

Worksheet.

13C AMOUNT OF LOUISIANA NONREFUNDABLE CHILD CARE CREDIT CARRIED FORWARD FROM 2010

13C

THROUGH 2013 – See Nonrefundable Child Care Credit Worksheet.

2014 LOUISIANA NONREFUNDABLE SCHOOL READINESS CREDIT – your Federal Adjusted Gross

Income must be GrEATEr THAN $25,000 to claim the credit on this line. See Nonrefundable School

Readiness Credit Worksheet.

13d

13D

5

4

3

2

13E AMOUNT OF LOUISIANA NONREFUNDABLE SCHOOL READINESS CREDIT CARRIED FORWARD

13E

FROM 2010 THROUGH 2013 – See Nonrefundable School Readiness Credit Worksheet.

14

14

EDUCATION CREDIT

15

15

OTHER NONREFUNDABLE TAx CREDITS – From Schedule G-NR, Line 10

16

TOTAL NONREFUNDABLE TAx CREDITS – Add Lines 13B through 15.

16

ADjUSTED LOUISIANA INCOME TAx – Subtract Line 16 from Line 12. If the result is less than zero, or

17

17

you are not required to file a federal return, enter zero “0.”

Amount from the Consumer Use

CONSUMER USE TAx

18

18

No use tax due.

Tax Worksheet, Line 2.

You must mark one of these boxes.

19

19

TOTAL INCOME TAx AND CONSUMER USE TAx – Add Lines 17 and 18.

CONTINUE ON NEXT PAGE

Enter the first

4 characters of

your last name

WEB

61572

in these boxes.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11