IT-540B WEB

(Page 4 of 4)

Enter your Social Security Number.

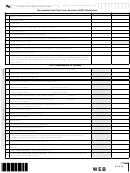

37

37

AMOUNT YOU OWE – If Line 19 is greater than Line 29, subtract Line 29 from Line 19.

38

AddITIONAL dONATION TO THE MILITAry FAMILy ASSISTANCE FUNd

38

39

AddITIONAL dONATION TO THE COASTAL PrOTECTION ANd rESTOrATION FUNd

39

AddITIONAL dONATION TO THE NATIONAL MULTIPLE SCLErOSIS

40

40

SOCIETy FUNd

41

AddITIONAL dONATION TO LOUISIANA FOOd BANK ASSOCIATION

41

42

AddITIONAL dONATION TO THE SNAP FrAUd ANd ABUSE dETECTION ANd PrEVENTION FUNd

42

43

43

INTEREST – From the Interest Calculation Worksheet, page 29, Line 5.

44

44

DELINqUENT FILING PENALTY – From the Delinquent Filing Penalty Calculation Worksheet, page 29, Line 7.

45

45

DELINqUENT PAYMENT PENALTY – From Delinquent Payment Penalty Calculation Worksheet, page 29, Line 7.

UNDERPAYMENT PENALTY – See instructions for Underpayment Penalty, page 29, and

46

46

Form R-210NR. If you are a farmer, check the box.

47

BALANCE DUE LOUISIANA – Add Lines 37 through 46. If mailing to

PAy THIS AMOUNT.

47

LDR, use address 1 below. For electronic payment options, see page 2.

IMPOrTANT

!

dO NOT SENd CASH.

All four (4) pages of this return

MUST be mailed in together along

with your W-2s and completed

schedules. Please paperclip.

do not staple.

I declare that I have examined this return, and to the best of my knowledge, it is true and complete. Declaration of paid preparer is based on all available information. If I made a

contribution to the START Savings Program, I consent that my Social Security Number may be given to the Louisiana Office of Student Financial Assistance to properly identify the

START Savings Program account holder. If married filing jointly, both Social Security Numbers may be submitted. I understand that by submitting this form I authorize the disburse-

ment of individual income tax refunds through the method as described on Line 36.

Your Signature

Date

Signature of paid preparer other than taxpayer

Spouse’s Signature (If filing jointly, both must sign.)

Date

Telephone number of paid preparer

Date

(

)

Enter the first 4 characters of your

last name in these boxes.

FOr OFFICE USE ONLy

Field

Social Security Number, PTIN, or

Flag

FEIN of paid preparer

Mail Balance due return with Payment

SPEC

Individual Income Tax return

1

TO: Department of Revenue

COdE

Calendar year return due 5/15/2015

P. O. Box 3550

Baton Rouge, LA 70821-3550

Mail All Other Individual Income Tax returns

2

TO: Department of Revenue

WEB

61574

P. O. Box 3440

Baton Rouge, LA 70821-3440

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11