ATTACH TO rETUrN IF COMPLETEd.

Enter your Social Security Number.

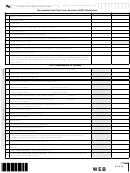

SCHEdULE F-Nr – 2014 REFUNDABLE TAx CREDITS

1

Credit for amounts paid by certain military service members for obtaining Louisiana Hunting and Fishing Licenses.

1A

Yourself

Date of Birth (MM/DD/YYYY)

Driver’s License number

State of issue

or State Identification

State of issue

1B

Spouse

Date of Birth (MM/DD/YYYY)

Driver’s License number

State of issue

or State Identification

State of issue

1C

Dependents: List dependent names.

Dependent name

Date of Birth (MM/DD/YYYY)

Dependent name

Date of Birth (MM/DD/YYYY)

Dependent name

Date of Birth (MM/DD/YYYY)

Dependent name

Date of Birth (MM/DD/YYYY)

1d

1D

Enter the total amount of fees paid for Louisiana hunting and fishing licenses purchased for the listed individuals.

Additional refundable Credits

Enter description and associated code, along with the dollar amount. See instructions beginning on page 18.

Code

Amount of Credit Claimed

Credit description

2

2

3

3

4

4

5

5

6

6

OTHEr rEFUNdABLE TAX CrEdITS - Add Lines 1D, and 2 through 6. Also, enter this amount

7

7

on Form IT-540B, Line 23.

description

Code

description

Code

description

Code

description

Code

Solar Energy Systems – Non-

Retention and Modernization

70F

Inventory Tax

50F

64F

Mentor-Protégé

57F

Leased

Conversion of vehicle to

71F

School Readiness Child Care

Ad valorem Natural Gas

51F

Alternative Fuel

Milk Producers

65F

58F

Provider

Research and Development

72F

School Readiness Child Care

Ad valorem Offshore vessels

52F

Technology Commercialization

59F

66F

Digital Interactive Media &

Directors and Staff

73F

Software

Telephone Company Property

54F

School Readiness Business –

Historic Residential

60F

67F

Supported Child Care

Solar Energy Systems – Leased

74F

Prison Industry Enhancement

55F

Angel Investor

61F

School Readiness Fees and

Other Refundable Credit

80F

Grants to Resource and Referral

68F

Musical and Theatrical

Urban Revitalization

56F

62F

Agencies

Productions

SCHEdULE H-Nr – 2014 MODIFIED FEDERAL INCOME TAx DEDUCTION

Enter the amount of your federal income tax liability as shown on the Federal Income Tax Deduction Worksheet,

1

1

page 13.

2

2

Enter the amount of federal disaster credits allowed by IRS.

Add Line 1 and Line 2. Also, enter this amount on Form IT-540B, Line 10D, and mark the box on Line 10D to

3

3

indicate that your income tax deduction has been increased.

WEB

61578

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11