Enter your Social Security Number.

ATTACH TO rETUrN IF COMPLETEd.

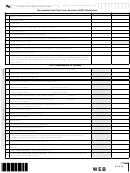

Nonresident and Part-year resident (NPr) Worksheet

See instructions for completing the NPR worksheet beginning on page 15.

Federal

Louisiana

1

Wages, salaries, tips, etc.

2

Taxable interest

3

Dividends

4

Business income (or loss) and Farm income (or loss)

5

Gains (or losses)

6

IRA distributions, Pensions and Annuities.

7

Rental real estate, royalties, partnerships, S corporations, trusts, etc.

8

Social Security benefits

9

Other income

10

Total Income – Add the income amounts on Lines 1 – 9 for each column.

11

Total Adjustments to Income

Adjusted Gross Income – Subtract Line 11 from Line 10 for each column. Enter the amount

in the Federal column on IT-540B, Line 7. The amount shown in the Federal column should

12

agree with Federal Form 1040EZ, Line 4, OR Federal Form 1040A, Line 21, OR Federal Form

1040, Line 37.

2014 Adjustments to Income

13

Interest and dividend income from other states and their political subdivisions

14

Recapture of START contributions

15

Total – Add Lines 12, 13, and 14.

16

Interest and Dividends on U.S. Government Obligations

Louisiana State Employees’ Retirement Benefits –

17

Taxpayer date retired: ____________________ Spouse date retired: ____________________

Louisiana State Teachers’ Retirement Benefits –

18

Taxpayer date retired: ____________________ Spouse date retired: ___________________

19

Federal Retirement Benefits – Date retired: Taxpayer ____________ Spouse: _____________

Other Retirement Benefits – Date retired: Taxpayer _____________ Spouse: _____________

20

Provide name or statute: _______________________________________________________________

Annual Retirement Income Exemption for Taxpayers 65 or over –

21

Provide name of pension or annuity: ___________________________________________________

22

Native American Income

23

START Savings Program Contribution

24

Military Pay Exclusion

25

Road Home

26

Recreation volunteer or volunteer Firefighter

27

voluntary Retrofit Residential Structure

28

IRC 280C Expense Adjustment

Elementary and Secondary School Tuition, Educational Expenses for Home-Schooled

29

Children, Educational Expenses for quality Public Education

30

Capital Gain from Sale of Louisiana Business

Other Exempt Income

31

Identify: ____________________________________________________________________________

Total Exempt Income – Add Lines 16 through 31.

32

LOUISIANA AdJUSTEd GrOSS INCOME. Subtract Line 32 from Line 15. Also, enter this

33

amount on Form IT-540B, Line 8.

WEB

61575

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11