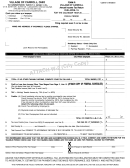

Form LB56F Instructions

General Instructions

Payment Options

Line Instructions

• Sales to a federal agency that the state

of Minnesota is prohibited from taxing

Every licensed farm winery in Minnesota

Electronic Payments

Line 1 — Beginning Inventory

• Sales to the established governing body

is required to collect and remit to the

If you paid more than $10,000 in

Enter the number of liters for each type

of an Indian tribe per M.S. 297G.08.

Department of Revenue the tax from the

Minnesota excise taxes during the last

of wine in columns A through F, and the

sale of wine.

fiscal year ending June 30, you are required

number of bottles in column G.

C2. You may qualify for a credit for

to make your payments electronically.

destroyed product if

Due Date

The beginning inventory must be the same

You must also pay electronically if you’re

as the previous period’s ending inventory.

• you’ve been ordered to destroy the

Tax returns and payments must be filed and

required to pay any Minnesota business

product by another government agency

paid by the 18th day of the month following

tax electronically, such as sales and with-

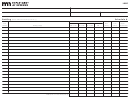

Line 2 — Schedule A Totals

or

the month in which the sales were made.

holding taxes.

Complete Schedule A to report the number

• insurance proceeds do not cover the tax

If the due date falls on a weekend or

of liters for each type of wine and the total

due for the destroyed product

Go to and

holiday, returns and payments received the

amount of bottles (exclude bottles con-

log in to e-Services. If you do not have

If you’re not sure if you qualify, please

next business day are considered timely.

taining less than 200ml in the bottle count)

Internet access, you can pay by phone at

contact us.

during the period.

Note: You must file a return even if you

1-800-570-3329. You’ll need your bank

C3. List any miscellaneous adjustments,

do not have a tax liability per Minnesota

routing and account numbers. When paying

corrections or transactions that decreased

Line 3 — Schedule B Totals

Statute 297G.09, subd. 1.

electronically, you must use an account not

your inventory. If using this schedule,

B1. List only those customer returns on

associated with a foreign bank.

please provide a description of the subtrac-

Penalties and Interest

which wine tax has been paid to the state,

tion listed.

Note: If you’re currently paying elec-

and for which a credit memo has been

A 5 percent late-payment penalty will be

tronically using the ACH credit method,

issued to the customer.

assessed on any unpaid tax for the first

Line 6 — Ending Inventory

continue to call your bank as usual. If you

30 days. The penalty increases 5 percent

B2. List customer returns on which wine

The ending inventory should agree with, or

wish to make payments using the ACH

for each additional 30-day period (or any

tax has not been paid to the state and any

reconcile to, your ending book inventory.

credit method, instructions are available at

part thereof) to a maximum of 15 percent.

tax-exempt sales that have been returned to

This will be your next period’s beginning

.

Returns filed after the due date will be

inventory during the period.

inventory.

assessed a 5 percent late-filing penalty on

Paying by Check

B3. List any miscellaneous adjustments/

Line 13 — Small Winery Credit

any unpaid tax, or if no tax is due a penalty

If you are paying by check:

corrections that increased your inventory

To qualify for this credit, you must be a

of $25 is assessed for each unfiled return.

such as samples or free goods not included

•

Go to our website at

small winery who, in the last calendar year,

Interest will accrue on any unpaid tax and

in the purchases.

mn.us and click on Make a Payment.

produced 75,000 gallons or less of wine

penalty.

and cider. Small wineries earn the credit

•

Click By Check to create and print a pay-

Line 5 — Schedule C Totals

ment voucher. Write your check to

during the calendar year and use the credit

C1. The following are considered tax-

Minnesota Revenue and mail together to

in the following fiscal year. For instance,

exempt sales:

the address on the voucher.

the credit on gallons produced January

• Sales for shipments out of state

1, 2017 through December 31, 2017 are

Your check authorizes us to make a one-time

• Sales to food producers or pharmaceu-

used July 1, 2018 through June 30, 2019.

electronic fund transfer from your account.

tical firms used exclusively in the manu-

Qualified small wineries are entitled to a

You may not receive your cancelled check.

facture of food products or medicines

tax credit equal the excise tax due on wine

or cider sold not to exceed $136,275.

• Sales to common carriers engaged in

interstate transportation of passengers

Line 15 — Audit Adjustments

• Sales to qualified approved military

List any audit adjustments or other credits

clubs

for the period.

• Sales or transfers between Minnesota

wholesalers

1

1 2

2 3

3 4

4 5

5