Rental Car Surcharge

The rental car surcharge is –

›

$2 per day or any part of a day

›

$1 per use by members of a car-sharing service

This surcharge is imposed on the lease or rental of motor vehicles designed to accommodate less than

nine passengers and on the use of such vehicles by members of a car-sharing service.

The surcharge does not apply to the lease or rental of:

•

motorcycles

•

mopeds

•

trucks

•

trailers

•

recreational vehicles

•

van conversions

The surcharge does not apply to the lease or rental of a motor vehicle to any entity that holds a Florida

Consumer’s Certificate of Exemption, direct pay permit, or other sales tax exemption.

When a motor vehicle is leased or rented in Florida, the surcharge applies, even though the vehicle may

be driven outside Florida. When a motor vehicle is leased or rented outside Florida, the surcharge does

not apply, even though the vehicle may be driven into Florida.

A $2 per day surcharge applies to the first 30 days, or portion of a day, a motor vehicle is continuously

leased or rented in Florida to one person. If a lease or rental is renewed, the surcharge applies to the

first 30 days of the renewal lease or rental agreement.

A $1 per use surcharge applies to the use of a motor vehicle by a member of a car-sharing service for a

period of less than 24 hours. If the member uses the motor vehicle for 24 hours or more in a single use,

the $2 per day surcharge applies.

Rental dealers are required to separately state the surcharge on the sales invoice and include the

surcharge in the amount subject to sales tax.

Tax on Gross Receipts of Dry-Cleaning and Dry Drop-Off Facilities

The Tax on Gross Receipts of Dry-Cleaning and Dry Drop-Off Facilities is 2 percent.

This tax is imposed on all charges by dry-cleaning and dry drop-off facilities that are in the business of

laundering and dry cleaning clothing and other fabrics.

The tax is not imposed on:

•

Coin-operated laundry machines

•

Laundry done on a wash, dry, and fold basis

•

Uniform rentals

•

Linen supply services

A dry-cleaning facility may pass the gross receipts tax on to its customers. There is no consumer

exemption. Entities that are exempt from paying sales and use tax, such as political subdivisions,

nonprofit religious institutions, or veterans’ organizations, are not exempt from gross receipts tax.

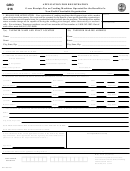

How to Register to Collect the Taxes and Fees

Businesses must register to collect new tire fees, lead-acid battery fees, rental car surcharges, and

gross receipts tax. You can register to collect and report taxes and fees through our website. The site

will guide you through an application interview that will help you determine your tax obligations. If you

do not have Internet access, you can complete a paper Florida Business Tax Application (Form DR-1).

Florida Department of Revenue, Solid Waste Fees, Motor Vehicle Fees,

and Gross Receipts Tax on Dry Cleaning, Page 3

1

1 2

2 3

3 4

4