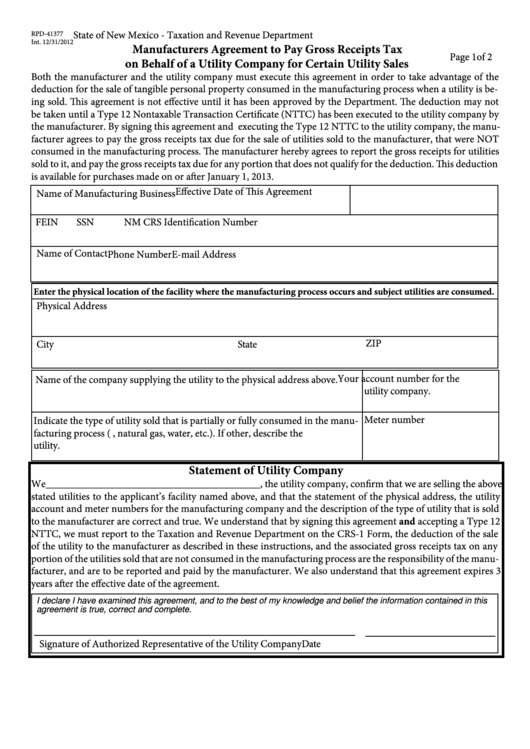

Form Rpd-41377 - Manufacturers Agreement To Pay Gross Receipts Tax On Behalf Of A Utility Company For Certain Utility Sales

ADVERTISEMENT

State of New Mexico - Taxation and Revenue Department

RPD-41377

Int. 12/31/2012

Manufacturers Agreement to Pay Gross Receipts Tax

Page 1of 2

on Behalf of a Utility Company for Certain Utility Sales

Both the manufacturer and the utility company must execute this agreement in order to take advantage of the

deduction for the sale of tangible personal property consumed in the manufacturing process when a utility is be-

ing sold. This agreement is not effective until it has been approved by the Department. The deduction may not

be taken until a Type 12 Nontaxable Transaction Certificate (NTTC) has been executed to the utility company by

the manufacturer. By signing this agreement and executing the Type 12 NTTC to the utility company, the manu-

facturer agrees to pay the gross receipts tax due for the sale of utilities sold to the manufacturer, that were NOT

consumed in the manufacturing process. The manufacturer hereby agrees to report the gross receipts for utilities

sold to it, and pay the gross receipts tax due for any portion that does not qualify for the deduction. This deduction

is available for purchases made on or after January 1, 2013.

Effective Date of This Agreement

Name of Manufacturing Business

FEIN

SSN

NM CRS Identification Number

Name of Contact

Phone Number

E-mail Address

Enter the physical location of the facility where the manufacturing process occurs and subject utilities are consumed.

Physical Address

ZIP

City

State

Your account number for the

Name of the company supplying the utility to the physical address above.

utility company.

Meter number

Indicate the type of utility sold that is partially or fully consumed in the manu-

facturing process (i.e. electricity, natural gas, water, etc.). If other, describe the

utility.

Statement of Utility Company

We_________________________________________, the utility company, confirm that we are selling the above

stated utilities to the applicant’s facility named above, and that the statement of the physical address, the utility

account and meter numbers for the manufacturing company and the description of the type of utility that is sold

to the manufacturer are correct and true. We understand that by signing this agreement and accepting a Type 12

NTTC, we must report to the Taxation and Revenue Department on the CRS-1 Form, the deduction of the sale

of the utility to the manufacturer as described in these instructions, and the associated gross receipts tax on any

portion of the utilities sold that are not consumed in the manufacturing process are the responsibility of the manu-

facturer, and are to be reported and paid by the manufacturer. We also understand that this agreement expires 3

years after the effective date of the agreement.

I declare I have examined this agreement, and to the best of my knowledge and belief the information contained in this

agreement is true, correct and complete.

Signature of Authorized Representative of the Utility Company

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3