Form Gt-800054 - New Dealer Guide To Working With The Florida Department Of Revenue Page 2

ADVERTISEMENT

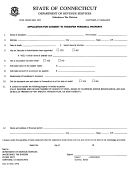

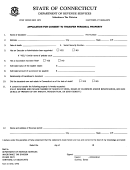

secondhand dealer or secondary metals recycler using a Registration Application for

Secondhand Dealers and/or Secondary Metals Recyclers (Form DR-1S).

•

If you sell tires or batteries; rent or lease motor vehicles to others; or operate a

dry-cleaning business, you must register to file and pay solid waste and surcharge and rental

car surcharge fees on the Solid Waste and Surcharge Return (Form DR-15SW).

Registered Florida Sales and Use Tax Dealer Responsibilities

As a registered dealer, you act as an agent of Florida and must:

•

Collect sales tax (state plus applicable local discretionary sales surtax) on each

taxable transaction.

•

Pay use tax on items you use in the business that you buy tax-exempt or remove

from inventory and do not resell.

•

Remit the tax you collect and pay the use tax you owe to the Florida Department of

Revenue. You can file and pay online or mail a Sales and Use Tax Return (Form

DR-15) with a check or money order.

•

Keep complete and accurate records for all your tax returns filed including cancelled

tax payment checks and sales and purchases documentation. Records must be

kept for at least three years.

The sales tax collected through your business transactions become state funds at the moment of

collection; you serve as a custodian of these funds until you remit them to the Department of

Revenue. Please keep accurate records and maintain separate accounting regarding these funds.

Filing Requirements

If you are not enrolled to file and pay electronically, a sales and use tax return will be mailed to you

for your first reporting period. A sales and use tax coupon book and instructions will also be mailed

to you to use for the remainder of the calendar year. It is your responsibility to file a return and

remit tax to the Department even if you do not receive returns. If you do not receive your tax

returns before your first due date, please contact the Department.

If you own multiple business locations, you may file a consolidated sales and use tax return. To

obtain a consolidated filing number, submit an Application for Consolidated Sales and Use

Tax Filing Number (Form DR-1CON) to the Department. This application is available online at

Due Date Information and Reminders

Returns and payments are due on the 1st and late after the 20th day of the month following each

reporting period, whether you are filing monthly, quarterly, twice a year or yearly. If the 20th falls

on a Saturday, Sunday or state or federal holiday, returns are timely if filed electronically,

postmarked or hand-delivered on the first business day after the 20th. Florida law requires you

to file a tax return even if you do not owe sales and use tax.

Monthly and quarterly filers can sign up to receive email reminders about approaching due dates

for each reporting period. Visit to sign up for email updates.

Electronic filers will automatically receive reminders and do not have to sign up for the subscription

service.

Penalty and Interest

Penalty: If you file your return or pay tax late, a late penalty of 10 percent of the amount of tax owed,

but not less than $50, may be charged. The $50 minimum penalty applies also to businesses who

file a late return even if no tax is due. Penalty will also be charged if your return is incomplete.

Interest - A floating rate of interest applies to underpayments and late payments of tax. Interest

rates are available on the Tax and Interest Rates web page of the Department’s website.

New Dealer Guide to Working with the Florida Department of Revenue, Page 2

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4