Form Dr-342000 - Request To Participate In The Certified Audit Program

ADVERTISEMENT

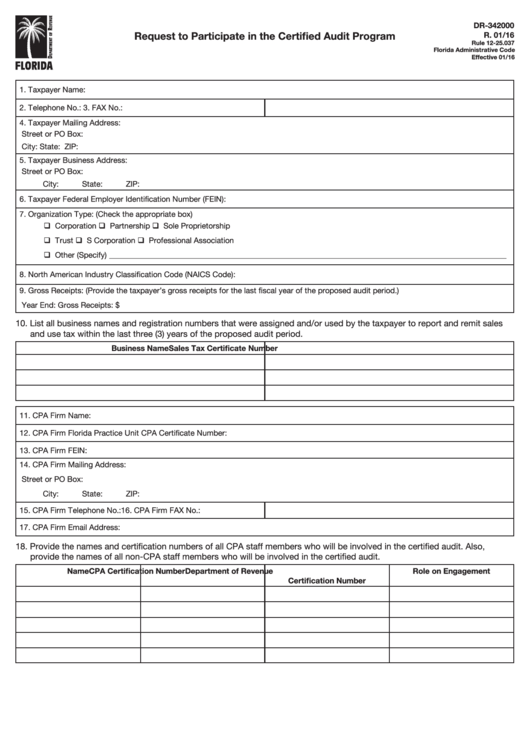

DR-342000

Request to Participate in the Certified Audit Program

R. 01/16

Rule 12-25.037

Florida Administrative Code

Effective 01/16

1. Taxpayer Name:

2. Telephone No.:

3. FAX No.:

4. Taxpayer Mailing Address:

Street or PO Box:

City:

State:

ZIP:

5. Taxpayer Business Address:

Street or PO Box:

City:

State:

ZIP:

6. Taxpayer Federal Employer Identification Number (FEIN):

7. Organization Type: (Check the appropriate box)

q Corporation

q Partnership

q Sole Proprietorship

q Trust

q S Corporation

q Professional Association

q Other (Specify) ______________________________________________________________________________________________________

8. North American Industry Classification Code (NAICS Code):

9. Gross Receipts: (Provide the taxpayer’s gross receipts for the last fiscal year of the proposed audit period.)

Year End:

Gross Receipts: $

10. List all business names and registration numbers that were assigned and/or used by the taxpayer to report and remit sales

and use tax within the last three (3) years of the proposed audit period.

Business Name

Sales Tax Certificate Number

11. CPA Firm Name:

12. CPA Firm Florida Practice Unit CPA Certificate Number:

13. CPA Firm FEIN:

14. CPA Firm Mailing Address:

Street or PO Box:

City:

State:

ZIP:

15. CPA Firm Telephone No.:

16. CPA Firm FAX No.:

17. CPA Firm Email Address:

18. Provide the names and certification numbers of all CPA staff members who will be involved in the certified audit. Also,

provide the names of all non-CPA staff members who will be involved in the certified audit.

Name

CPA Certification Number

Department of Revenue

Role on Engagement

Certification Number

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5