*130104X=39999*

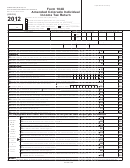

37. If line 25 is larger than line 33, enter the amount owed

37

00

38. Enter the amount owed from your original return or as previously adjusted

38

00

Compute the Amount Owed

39. Line 36 minus line 35, but not less then zero

39

00

40. Line 37 minus line 38, but not less than zero

40

00

41. Additional tax due, total of lines 39 and 40

41

00

42. Interest due on additional tax

42

00

43. Penalty due

43

00

44. Estimated tax penalty due

44

00

Paid by EFT

45. Payment due with this return, add lines 41 through 44

45

00

The State may convert your check to a one time electronic banking transaction. Your bank account may be debited as early as the same day received by the State. If converted, your

check will not be returned. If your check is rejected due to insufficient or uncollected funds, the Department of Revenue may collect the payment amount directly from your bank account

electronically.

Pay online at

We strongly recommend that you file using Revenue Online. If you cannot efile, you may mail it to:

Colorado Department of Revenue, Denver, CO 80261-0005

Compute the Refund

46. Line 35 minus line 36, but not less than zero

46

00

47. Line 38 minus line 37, but not less than zero

47

00

48. Overpayment, total of lines 46 and 47

48

00

49. Amount you want credited to 2014 estimated tax.

49

00

50. Refund claimed with this return, line 48 minus line 49

50

00

File using Revenue Online and enter Direct Deposit information to get your refund in half the time!

Direct

Type:

Checking

Routing Number

Savings

Deposit

Account Number

Sign your return

Under penalties of perjury, I declare that to the best of my knowledge and belief, this return is true, correct and complete.

Your Signature

(MM/DD/YY)

Date

Spouse’s Signature. If joint return, both must sign

(MM/DD/YY)

Date

Paid Preparer’s Last Name

First Name

Middle Initial

Paid Preparer’s Address

Phone Number

(

)

City

State

Zip

1

1 2

2 3

3 4

4