Form Nyc-Tclt - Taxicab License Transfer Tax Return Page 2

ADVERTISEMENT

Form NYC-TCLT

Page 2

-

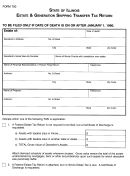

SCHEDULE B

Calculation of consideration subject to tax

6. Total consideration for a) the transfer of a taxicab license or interest in the license and

b) the taxicab or other property transferred in conjuction with the transfer without any deduction ....... 6.

7. Less: fair market value of the taxicab or other property, if also transferred........................................... 7.

8. Consideration subject to tax (enter on Schedule A, line 1, page 1)....................................................... 8.

LEGISLATIVE HIGHLIGHT

Where a taxicab or any other property is transferred to a transferee in conjunction

with the transfer of a taxicab license or interest, the tax is computed on the total

Effective March 21, 2017, Local Law 58 of 2017 changed the tax

consideration for the transfer of the license or interest plus the taxicab or other

rate on the transfer of a taxicab license from 5% of the consider-

property transferred, less the fair market value of the taxicab or other property.

ation given to 0.5% of the consideration given for such transfer.

FILING OF RETURN AND PAYMENT OF TAX

DEFINITIONS

The tax must be paid by the transferee. The transferor is liable for payment

Taxicab

of the tax if the tax is not paid by the transferee. No transfer of a taxicab li-

cense or interest in the license can be approved by the Taxi and Limousine

Any motor vehicle carrying passengers for hire in the City, duly licensed as a

Commission until the tax has been paid.

taxicab by the Taxi and Limousine Commission and permitted to accept hails

from passengers in the street.

At the time of payment Form NYC-TCLT must be filed jointly by the trans-

Taxicab license

feree and transferor. The return and remittance made payable to the order of:

NYC Department of Finance, must be sent to:

A license issued by the Taxi and Limousine Commission under Section 19-504

of Title 19 of the NYC Administrative Code to operate a taxicab.

Taxi and Limousine Commission

33 Beaver Street, 22nd Floor

Consideration

New York, NY 10004

The total price paid or agreed to be paid for the transfer of a taxicab license or

interest in the license, whether paid or agreed to be paid in money, property,

Upon approval by the TLC, the return and payment will be forwarded to the

or in any other thing of value (including the cancellation or discharge of an in-

NYC Department of Finance.

debtedness or obligation), without any deduction.

INTEREST

Transfer

Any transfer of interest, whether or not the interest constitutes title, or possession,

If the tax is not paid on or before the due date (determined without regard to

or both, exchange or barter, rental, lease, or license to use, conditional or otherwise,

any extension of time), interest must be paid on the amount of the underpay-

in any manner or by any means whatsoever for a consideration, or any agreement

ment from the due date to the date paid. For information regarding interest

therefor. The tax shall not apply to the transfer of the taxicab license or interest in

rates, visit the Finance website at nyc.gov/finance or call 311. If calling from

the license by means of a lease, license, or other rental arrangement, where the term

outside the five NYC boroughs, call 212-NEW-YORK (212-639-9675).

of the lease, license or other rental arrangement (including the maximum period

PENALTIES

for which it can be extended or renewed) does not exceed six months.

Transferee

a)

If you fail to file a return when due, add to the tax (less any payments

The person to whom a taxicab license or interest in the license is transferred

made on or before the due date) 5% for each month or partial month the

in a transfer, as defined above.

form is late up to 25%, unless the failure is due to reasonable cause.

Transferor

b)

If the return is filed more than 60 days late, the minimum late filing

The person who transfers a taxicab license or interest in the license in a trans-

penalty will be equal to the lesser of a) $100 or b) 100% of the tax due

fer, as defined above.

required to be shown on the return, less any payments or credits claimed.

c)

If you fail to pay the tax shown on the return by the prescribed filing

IMPOSITION OF TAX

date, add to the tax, (less any payments made) 1/2% for each month or

partial month the payment is late up to 25%, unless the failure is due to

Effective on or after March 21, 2017, NYC Administrative Code Section 11-

reasonable cause.

1402 imposes a tax on each transfer of a taxicab license or interest in the license,

at the rate of .5% of the consideration (Schedule A, line 1) given for the trans-

d)

The total of the additional charges in a) and c) may not exceed 5% for any

fer. If the transfer occurred prior to March 21, 2017, use the previous form.

one month except as provided for in b).

If there is a transfer of the economic interest in a taxicab license brought about

e)

Additional penalties may be imposed due to negligence or fraud.

by the transfer of shares of stock of a corporation that holds the taxicab li-

If you claim not to be liable for these penalties, a statement in support of your

cense or interest, or the transfer of an interest or interests in a partnership or

claim should be attached to the return.

association which holds the taxicab license or interest, this transfer is treated

as a transfer of the taxicab license or interest, and is subject to the tax.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2