Form Nyc-204 - Unincorporated Business Tax Return For Partnerships (Including Limited Liability Companies) - 2017 Page 3

ADVERTISEMENT

Form NYC-204 - 2017

Page 3

Name

EIN

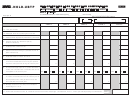

S C H E D U L E B

Computation of Total Income

Items of income, gain, loss or deduction

Part 1

Ordinary income (loss) from federal Form 1065, line 22 or 1065-B, Part I, line 25 (see instr.) .......... 1.

1.

2.

Net income (loss) from all rental real estate activity not included in Form 1065, line 22 or 1065-B,

Part I, line 25 but included on federal Schedule K .............................................................................. 2.

3.

All portfolio income such as interest, dividends, royalties, annuity income and gain (loss) on the disposition of property not

... 3.

included in Form 1065, line 22 or 1065-B, Part I, line 25, but included on federal Sch. K (attach sch. of all portfolio income)

Guaranteed payments to partners from federal Schedule K (see instructions) ................................. 4.

4.

5.

5.

Payments to current and retired partners included in other deductions from federal Form 1065, line 20 or 1065-B, Part I, line 23.....

6.

6.

Other income not included in Form 1065, line 22 or 1065-B, Part I, line 25, but included on federal Sch. K ( attach sch. of other income ) ....

Charitable contributions from federal Schedule K .................... 7.

7.

8.

8.

Other deductions included in Form 1065, line 22 or 1065-B, Part I, line 25 and Part II, line 13, but not allowed for UBT (attach sched.) (see inst.)......

Other income and expenses not included above that are required to be reported separately

9.

to partners (attach schedule) (see instructions) ................................................................................. 9.

10.

Total federal income (combine lines 1 through 9, do not include line 7) ............................................ 10.

11.

Subtract net income or gain (or add net loss) from rental, sale or exchange of real property

situated outside NYC if included in line 10 above (attach schedule)

........................ 11.

(see instructions)

Total income before New York City modifications (combine line 10 and line 11) ............................... 12.

12.

New York City modifications (see instructions for Schedule B, part 2)

Part 2

PARTNER A

PARTNER B

PARTNER C

TOTAL

A D D I T I O N S

EIN OR SSN

13.

All income taxes and Unincorporated Business Taxes ...13.

13.

(a) Relocation credits ....................................................14a.

14.

14a.

(b) Expenses related to exempt income .......................14b.

14b.

(c) Depreciation adjustments

(see instr. and attach Form

.........................................14c.

14c.

NYC-399 and/or NYC-399Z)

(d) Exempt Activities .....................................................14d.

14d.

Other additions (attach schedules)

.....15.

15.

15.

(see instructions )

16.

Total additions (add lines 13 through 15) .......................16.

16.

PARTNER A

PARTNER B

PARTNER C

TOTAL

S U B T R A C T I O N S

17.

All income tax and Unincorporated Business Tax

refunds (included in part 1) .............................................17.

17.

18.

wages and salaries subject to federal jobs credit

18.

(see instructions) .............................................................18.

Depreciation adjustment

19.

(see instr. and attach Form

19.

................................................19.

NYC-399 and/or NYC-399Z)

Exempt income (included in part 1, line 10) (see instr.)...20.

20.

20.

21.

50% of dividends

21.

21.

(see instructions) ........................................

22.

Exempt Activities

22.

22.

.....................................................................

Other subtractions (attach schedule)

...23.

23.

23.

(see instructions )

24.

Total subtractions (add lines 17 through 23) ...................24.

24.

25.

Combine lines 16 and 24 (total) .............................................................................................

25.

Total income (combine lines 12 and 25) .................................................................................

26.

26.

27.

Less: Charitable contributions (not to exceed line 7, or 5% of line 26, whichever is less) ......

27.

Balance (line 26 less line 27) ..................................................................................................

28.

28.

Investment income - (complete lines a through g below) (see instructions)

29.

(a) Dividends from stocks held for investment ....................................................................................... 29a.

(b) Interest from investment capital (include non-exempt governmental obligations) (itemize on rider) .... 29b.

(c) Net capital gain (loss) from sales or exchanges of securities held for investment............. 29c.

(d) Income from assets included on line 3 of Schedule D ....................................................... 29d.

(e) Add lines 29a through 29d inclusive .................................................................................. 29e.

(f) Deductions directly or indirectly attributable to investment income.................................... 29f.

(g) Interest on bank accounts included in income reported on line 29d ... 29g.

30.

Investment income (line 29e less line 29f) (enter on page 1, Sch. A, line 7a) ....................................30.

Business income (line 28 less line 30) (enter here and transfer this amount to page 1, Sch. A, line 1.).....31.

31.

60431791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6