Form Nyc-204 - Unincorporated Business Tax Return For Partnerships (Including Limited Liability Companies) - 2017 Page 6

ADVERTISEMENT

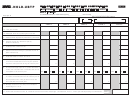

Form NYC-204 - 2017

Page 6

Name

EIN

If you are taking a Net Operating Loss Deduction this year, please attach Form

S C H E D U L E F

NYC-NOLD-UBTP. If you have a loss on Page 1, Line 10 which you are carrying

forward, please attach Form NYC-NOLD-UBTP and enter that value on Line 6.

S C H E D U L E G

The following information must be entered for this return to be complete

1. Nature of business or profession:

_______________________________________________________________________________________________________________________________

2. New York State Sales Tax ID Number:________________________________________

n

n

n

n

2016:

3. Did you file a New York City Partnership Return for the following years: ...................2015:

YES

NO

YES

NO

If

state reason:

"NO,"

____________________________________________________________________________________________________________________________________________

4. If business terminated during the current taxable year, state date terminated.

_______-_______-_______

(mm-dd-yy)

(Attach a statement showing disposition of business property.)

5. Has the Internal Revenue Service or the New York State Department of Taxation and Finance increased

n

n

or decreased any taxable income reported in any tax period, or are you currently being audited ? ................................................

YES

NO

-

-

-

-

If "YES", by whom? .............

State period(s): Beg.:_____

______

_____ End.:_____

______

_____

Internal Revenue Service

q

-

-

-

-

MM

DD

YY

MM

DD

YY

-

-

-

-

State period(s): Beg.:_____

______

_____ End.:_____

______

_____

New York State Department of Taxation and Finance

q

-

-

-

-

MM

DD

YY

MM

DD

YY

6.

Has Form NYC-115 (Report of Federal/State Change in Taxable Income) been filed?

n

n

Only applicable for years prior to 1/1/15. For years beginning on or after 1/1/15, file an amended return. (see instructions).............

YES

NO

n

n

7.

.....................................

YES

NO

Did you calculate a depreciation deduction by the application of the federal Accelerated Cost Recovery System (ACRS)? (see instr.)

n

n

8.

were you a participant in a "Safe Harbor Leasing" transaction during the period covered by this return?....................................................

YES

NO

At any time during the taxable year, did the partnership have an interest in real property (including a leasehold

9.

n

n

interest) located in NYC or in an entity owning such real property?...............................................................................................................

YES

NO

10. If "YES" to 9:

Attach a schedule of the property, indicating the nature of the interest and including the street address, borough, block and lot number.

a)

was any NYC real property (including a leasehold interest) or interest in an entity owning NYC real property,

b)

n

n

acquired or transferred with or without consideration? ............................................................................................................................

YES

NO

n

n

was there a partial or complete liquidation of the partnership?...............................................................................................................

YES

NO

c)

n

n

.............................................

YES

NO

d)

was 50% or more of the partnership ownership transferred during the tax year, over a three-year period, or according to a plan?

n

n

11. If "YES" to 10b, 10c or 10d, was a Real Property Transfer Tax Return filed? ................................................................................................

YES

NO

12. If "NO" to 11, explain:

___________________________________________________________________________________________________________________________________________________________

___________________________________________________________________________________________________________________________________________________________

13. Does this taxpayer pay rent greater than $200,000 for any premises in NYC in the borough of Manhattan south of

n

n

96th Street for the purpose of carrying on any trade, business, profession, vocation or commercial activity?....................................

YES

NO

n

n

14. If "YES", were all required Commercial Rent Tax Returns filed? .........................................................................................................

YES

NO

Please enter Employer Identification Number which was used on the Commercial Rent Tax Return:___________________________

C E R T I F I C AT I O N

Firm's Email Address:

I hereby certify that this return, including any accompanying rider, is, to the best of my knowledge and belief, true, correct and complete.

__________________________________________

n

I authorize the Department of Finance to discuss this return with the preparer listed below. (see instructions) ....YES

Preparer's Social Security Number or PTIN

Signature of taxpayer:

Title:

Date:

-

-

MM

DD

YY

Preparer's

Preparer’s

signature:

printed name:

Date:

Firm's Employer Identification Number

-

-

MM

DD

YY

n

Check if

self-employed

Firm's name

▲ Address

▲ zip Code

MAILING INSTRUCTIONS

Attach federal form 1065 or 1065-B and all accompanying schedules including the individual K-1s

Make remittance payable to the order of NYC DEPARTMENT OF FINANCE. Payment must be made in U.S. dollars and drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

The due date for the calendar year 2017 return is on or before March 15, 2018.

For fiscal years beginning in 2017, file on or before the 15th day of the third month following the close of the fiscal year.

ALL RETURNS EXCEPT REFUND RETURNS

RETURNS CLAIMING REFUNDS

REMITTANCES

PAY ONLINE WITH FORM NYC-200V

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

AT NYC.GOV/ESERVICES

UNINCORPORATED BUSINESS TAX

UNINCORPORATED BUSINESS TAX

OR

P.O. BOX 5564

P.O. BOX 5563

Mail Payment and Form NYC-200V ONLY to:

BINGHAMTON, NY 13902-5564

BINGHAMTON, NY 13902-5563

NYC DEPARTMENT OF FINANCE

P.O. BOX 3933

60461791

NEw YORK, NY 10008-3933

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6