Form Nyc-204 - Unincorporated Business Tax Return For Partnerships (Including Limited Liability Companies) - 2017 Page 5

ADVERTISEMENT

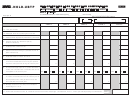

Form NYC-204 - 2017

Page 5

Name

EIN

ALLOCATION OF BUSINESS INCOME

ALLOCATION

NON ALLOCATION

Taxpayers who allocate income outside the City:

Taxpayers who do not allocate business income:

- complete Schedule E, Parts 1, 2 and 3 (below) and

- omit Schedule E, Parts 1 and 2 (below)

- Enter percentage rounded to the nearest one hundredth of a percentage point on Sched. A, line 2

- enter 100% on Schedule E, Part 3, line 5 and 100% on Schedule A, line 2

S C H E D U L E E

Complete this schedule if business is carried on both inside and outside New York City

List location of each place of business INSIDE New York City, nature of activities at each location (manufacturing, sales office, executive office,

Part 1

public warehouse, contractor, converter, etc.), and number of employees, their wages, salaries and duties at each location.

Complete Address

Rent

Nature of Activities

No. of Employees

wages, Salaries, Etc.

Duties

NUMBER AND STREET

CITY

STATE

zIP

NUMBER AND STREET

CITY

STATE

zIP

NUMBER AND STREET

CITY

STATE

zIP

NUMBER AND STREET

CITY

STATE

zIP

Total

List location of each place of business OUTSIDE New York City, nature of activities at each location (manufacturing, sales office, executive office,

Part 2

public warehouse, contractor, converter, etc.), and number of employees, their wages, salaries and duties at each location.

Complete Address

Rent

Nature of Activities

No. of Employees

wages, Salaries, Etc.

Duties

NUMBER AND STREET

CITY

STATE

zIP

NUMBER AND STREET

CITY

STATE

zIP

NUMBER AND STREET

CITY

STATE

zIP

NUMBER AND STREET

CITY

STATE

zIP

Total

Formula Basis Allocation of Income

Part 3

DESCRIPTION OF ITEMS USED AS FACTORS

COLUMN A - NEW YORK CITY

COLUMN B - EVERYWHERE

COLUMN C

1. Average value of the real and tangible

PERCENTAGE IN

personal property of the business (see instr)

NEW YORK CITY

a. Business real property owned.................................... 1a.

b. Business real property rented from others (rent x 8) . 1b.

(COLUMN A

DIVIDED BY

c. Business tangible personal property owned .............. 1c.

COLUMN B)

d. Business tangible personal property rented from others (rent x 8)... 1d.

e. Total of lines 1a - 1d ................................................... 1e.

%

f. Multiply Column C of line 1e by 3.5 .............................1f.

2a. Wages, salaries and other personal service

%

compensation paid to employees during the year ..... 2a.

2b. Multiply Column C of line 2a by 3.5 ............................2b.

3a. Gross sales of merchandise or

%

charges for services during the year .......................... 3a.

3b. Multiply Column C of line 3a by 93 ....................................................................................................................................................3b.

Weighted Factor Allocation

4a. Add Column C, lines 1f, 2b and 3b ....................................................................................................................................................4a.

4b. Divide line 4a by 100 if no factors are missing. If a factor is missing, divide line 4a by the total of the

weights of the factors present. Enter as percentage. Round to the nearest one hundredth of a percentage point ........................4b.

%

Business Allocation Percentage

%

5. Enter percentage from line 4b. Transfer to page 1, Schedule A, line 2. See instructions ...................................................................5.

n

n

6.

IS ANY PLACE OF BUSINESS LISTED IN PARTS 1 AND 2 LOCATED IN A PARTNER'S HOME? ..................

YES

NO

n

n

.....................

7.

DID YOU CLAIM A DEDUCTION FOR EXPENSES OF AN OFFICE IN A PARTNER'S HOME?

YES

NO

-

1065

1065-

'

1

60451791

ATTACH FEDERAL FORM

B AND ALL ACCOMPANYING SCHEDULES INCLUDING THE INDIVIDUAL K

S

OR

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6