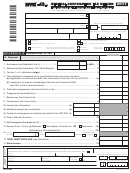

Form Nyc-3a - Combined General Corporation Tax Return - 2017 Page 12

ADVERTISEMENT

Form NYC-3A - 2017

Page 12

Pa r t I I I

E n t i t i e s I n c l u d e d i n C o m b i n e d R e t u r n ( s e e b e l o w )

n

n

Are any entities included in the Combined General Corporation Tax return that were not included in the return for the prior period? YES

NO

Complete this schedule for each corporation included in the Combined General Corporation Tax Return that (i) was not included in the Combined General Corpora-

tion Tax Return for the prior tax period; or (ii) for which there has been any material change in the stock ownership or activity during the tax period covered by this

report.

Explain how the filing of a return on a separate basis distorts the corporationʼs activities, business, income or capital in New York City, including the nature of the busi-

ness conducted by the corporation, the source and amount of its gross receipts and expenses and the portion of each derived from transactions with other included

corporations.

NAME OF CORPORATION

EMPLOYER IDENTIFICATION NUMBER

REASON(S) INCLUDED IN COMBINED GENERAL CORPORATION TAX RETURN

__________________________________________

____________________________ ________________________________________________________________________

__________________________________________

____________________________ ________________________________________________________________________

__________________________________________

____________________________ ________________________________________________________________________

__________________________________________

____________________________ ________________________________________________________________________

__________________________________________

____________________________ ________________________________________________________________________

__________________________________________

____________________________ ________________________________________________________________________

__________________________________________

____________________________ ________________________________________________________________________

__________________________________________

____________________________ ________________________________________________________________________

If additional space is required, please use this format on a separate sheet and attach to this page.

Pa r t I V

E n t i t i e s N o t I n c l u d e d i n C o m b i n e d R e t u r n ( s e e b e l o w )

n

n

Are any entities excluded from the Combined General Corporation Tax return that were included in the return for the prior period? YES

NO

Complete this schedule for each corporation excluded from the Combined General Corporation Tax Return that (i) was included in the Combined General Corpora-

tion Tax Return for the prior tax period; or (ii) for which there has been any material change in the stock ownership or activity during the tax period covered by this

report.

Explain the reason(s) for the exclusion of each corporation from the combined return, including a description of the nature of the business conducted by the corpora-

tion, the source and amount of its gross receipts and expenses and the portion of each derived from transactions with other included corporations.

301121791

301121791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12