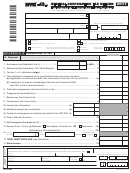

Form Nyc-3a - Combined General Corporation Tax Return - 2017 Page 9

ADVERTISEMENT

Form NYC-3A - 2017

: ___________________________________________

: _________________________

Page 9

NAME OF REPORTING CORPORATION

EIN

SCHEDULE M

Summary

COMBINED TOTALS

1.

New York City investment income (Schedule B, line 22b, column E x Schedule D, line 5, column E).................. 1. _________________________

2a.

New York City business income (Schedule B, line 23, column E x Schedule h, line 5, column E) ................ 2a. _________________________

2b.

If the amount on line 2a is not correct, enter correct amount here and explain on rider (see instructions)..... 2b. _________________________

3.

Total New York City income, line 1 plus line 2a or 2b ................................................................................... 3. _________________________

4.

Total on line 3................................................................................................................................................ 4. _________________________

5.

Allocated combined net income from line 4 (enter here and on Schedule A, line 1) .................................... 5. _________________________

6.

New York City investment capital (Schedule E, line 10, column E x Schedule D, line 5, column E) ............ 6. _________________________

7.

New York City business capital (Schedule E, line 11, column E x Schedule h, line 5, column E)................ 7. _________________________

8.

NYC investment & business capital (add lines 6 and 7) (enter here and on Schedule A, line 2) ................. 8. _________________________

9.

New York City subsidiary capital (Schedule C, line 4 column E) (enter here and on Schedule A, line 5)..... 9. _________________________

10.

Issuer's allocation percentage (Schedule M, add lines 8 and 9 divided by Schedule E, line 7, column E)

%

Enter here and on Schedule A, line 24. (See instructions)......................................................................... 10. _________________________

11.

Number of Subsidiaries: ......................................................................11. _____________________

Number of taxable subsidiaries with NYC gross receipts of:

11a. Not more than $100,000: ...........................................11aa. ______________________ X $25

.....11ab. _________________________

11b. More than $100,000 but not over $250,000:..............11ba. ______________________ X $75

.....11bb. _________________________

11c. More than $250,000 but not over $500,000: ..............11ca. ______________________ X $175 .....11cb. _________________________

11d. More than $500,000 but not over 1,000,000:.............11da. ______________________ X $500 .....11db. _________________________

11e. More than $1,000,000 but not over $5,000,000: ........11ea. ______________________ X $1500 .....11eb. _________________________

11f. More than $5,000,000 but not over $25,000,000:.......11fa. ______________________ X $3500 ......11fb. _________________________

11g. Over $25,000,000: ....................................................11ga. ______________________ X $5000 .....11gb. _________________________

12.

Minimum tax for taxable corporations (add lines 11ab through 11gb) (enter here and on Schedule A, line 7) ... 12. _________________________

30191791

30191791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12