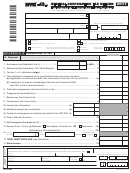

Form Nyc-3a - Combined General Corporation Tax Return - 2017 Page 2

ADVERTISEMENT

Form NYC-3A - 2017

: _______________________________________________

: ________________________

Page 2

NAME OF REPORTING CORPORATION

EIN

Computation of Tax -

SCHEDULE A - Continued

BEGIN WITH SCHEDULE B ON PAGE 3. COMPLETE ALL OTHER SCHEDULES. TRANSFER APPLICABLE AMOUNTS TO SCHEDULE A.

24.

24.

Combined group’s issuer's allocation percentage (from Schedule M. line 10) .....................................

%

25.

25.

Gross receipts or sales (See instructions)..............................................................................................

26.

26.

Total assets (Schedule E, line 1, column E) ..........................................................................................

27.

27.

Compensation of more than 5% stockholders as used in computation of line 3 (Sch. F, line 1, col. E) ..

28.

28.

NYC rent deducted on federal tax return .................................................................................................

%

29.

29.

Combined group Business Allocation Percentage (Schedule h, line 5, column E)................................

30.

30.

Number of Subsidiaries_________________ Number of taxable Subsidiaries_________________

P R E PAY M E N T S S C H E D U L E

,

16

DATE

AMOUNT

PREPAYMENTS CLAIMED ON SCHEDULE A

LINE

A. Mandatory first installment paid with preceding year's tax.........................................

B. Payment with Declaration, Form NYC-400 (1)...........................................................

C. Payment with Notice of Estimated Tax Due (2)..........................................................

D. Payment with Notice of Estimated Tax Due (3)..........................................................

E. Payment with extension, Form NYC-EXT ..................................................................

F. Overpayment from preceding year credited to this year ............................................

G. Total prepayments from subsidiaries (attach rider) ...................................................

H. TOTAL of A through G (enter on Schedule A, line 16) ...................................................

A LT E R N AT I V E TA X S C H E D U L E

Refer to instructions before computing the alternative tax.

Net income/loss (See instructions) ......................................................................................................................................................................... 1. $ _________________________

Enter 100% of salaries and compensation for the taxable year paid to stockholders owning

more than 5% of the taxpayer’s stock. (See instructions.) ............................................................................................................................... 2. $ _________________________

Total (line 1 plus line 2) ........................................................................................................................................................................................... 3. $ _________________________

Statutory exclusion - Enter $40,000. (if return does not cover an entire year, exclusion must be prorated

based on the period covered by the return)............................................................................................................................................................ 4. $ _________________________

Net amount (line 3 minus line 4) ............................................................................................................................................................................. 5. $ _________________________

15% of net amount (line 5 x 15%)........................................................................................................................................................................... 6. $ _________________________

Investment income to be allocated (amount on Schedule B, line 22b, Column E x 15%.

if not applicable.) .................................................................................................. 7. $ _________________________

Do not enter more than the amount on line 6 above. Enter

0

"

"

Business income to be allocated (line 6 minus line 7) .......................................................................................................................................... 8. $ _________________________

%

Allocated investment income (line 7 x investment allocation % from Schedule D, line 5) ....................................... 9. $ _________________________

%

Allocated business income (line 8 x business allocation % from Schedule h, line 5) ..............................................10. $ _________________________

Taxable net income (line 9 plus line 10).....................................................................................................................11. $ _________________________

8.85% (.0885)

Tax rate ........................................................................................................................................................................12.

_________________________

Alternative tax (line 11 x line 12) Transfer amount to page 1, Schedule A, line 3 .......................................................13. $ _________________________

-

NEW MAILING INSTRUCTIONS

DO NOT INCLUDE PAYMENT WITH RETURN

Attach copy of all pages of your federal tax return 1120S.

Make remittance payable to the order of NYC DEPARTMENT OF FINANCE. Payment must be made in U.S. dollars and drawn on a U.S. bank.

To receive proper credit, you must enter your correct Employer Identification Number on your tax return and remittance.

The due date for the calendar year 2017 return is on or before March 15, 2018.

For fiscal years beginning in 2017, file on or before the 15th day of the 3rd month following the close of the fiscal year.

ALL RETURNS EXCEPT REFUND RETURNS

REMITTANCES

RETURNS CLAIMING REFUNDS

PAY ONLINE WITH FORM NYC-200V

NYC DEPARTMENT OF FINANCE

NYC DEPARTMENT OF FINANCE

AT NYC GOV/ESERVICES

GENERAL CORPORATION TAX

GENERAL CORPORATION TAX

P.O. BOX 5564

OR

P.O. BOX 5563

Mail Payment and Form NYC-200V ONLY to:

BINGhAMTON, NY 13902-5564

BINGhAMTON, NY 13902-5563

NYC DEPARTMENT OF FINANCE

P.O. BOX 3933

NEW YORK, NY 10008-3933

30121791

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12